This post was updated on March 21, 2025.

Doing Business in Mexico

Mexico has solidified its reputation as a global manufacturing hub. Its unique position—bordering the United States, backed by free trade agreements, and home to a skilled and competitive workforce—makes it an ideal destination for international manufacturers. Whether you're a global enterprise or a growing mid-market company, doing business in Mexico offers strategic advantages for supply chain optimization, cost-efficiency, and market access. This guide introduces key insights for entering and expanding in Mexico through The Mexico Journey™, Prodensa’s proven, turnkey framework.

Overview of Mexico’s Manufacturing Sector

Mexico has emerged as a prominent player in the global manufacturing industry. With its strategic location, skilled labor force, and favorable trade agreements, Mexico has attracted numerous manufacturers from around the world. The country boasts a diverse range of manufacturing sectors, including automotive, aerospace, electronics, textiles, and more.

Mexico is a major exporter of manufactured goods, accounting for about 80% of all goods manufactured. The United States is the top destination for these manufacturing exports, followed by Canada and China. Mexico has the 15th largest economy in the world. The major exports include:

- Light Vehicles ($47B)

- Data Processing Machines ($43B)

- Automotive Parts ($38B)

- Heavy Vehicles ($33B)

Different industrial corridors have developed in Mexico, to formalize clusters and create hubs for efficient supply chain and service industries. These corridors reinforce economic growth and investment by advancing talent, infrastructure, communications, among other industry support.

The right location for a manufacturing operation depends on a number of crucial factors. It is discovered through the first three stages of The Mexico Journey™.

The Mexico Journey™

The Mexico Journey™ is the flagship solution from Prodensa. It is a comprehensive, turnkey solution helping clients launch and grow their operations in Mexico through a project management methodology, strategic advisory, corporate planning and hands-on support. Over 1,000 organizations have partnered with Prodensa doing business in Mexico.

The following guide will help a manufacturer plan their expansion in Mexico, and know when to seek support with their operations launch.

– Understand the Mexican Environment

– Understand the Mexican Environment

The legal frameworks in Mexico are constantly evolving. The Mexican Constitution is the supreme law of the land. It holds the highest authority. The Mexican Constitution establishes basic principles of government. It includes more than 2,600 federal, state and local laws and regulations. Some of these include the Federal Civil Code, the Federal Criminal Code, the General Law of Commercial Companies, and the Federal and Commercial Code.

Mexico has a legal system known as Civil Law, and it is very formal and bureaucratic. The notary public office in Mexico holds a lot of weight and responsibility. For foreign companies, this will most likely require a power of attorney and partner to facilitate.

Foreign investors can own 100% of a Mexican corporation, although certain industries may have restrictions. There are two main types of corporations in Mexico:

- Sociedades anónimas (SA’s) which are similar to U.S. corporations

- Sociedades de responsabilidad limitada (SRLs) which are similar to LLC’s in the United States

Mexico is a federal republic and the president is elected to a six-year term. There is no reelection.

– Design the Business Case

– Design the Business Case

An Institutional Relations strategy helps an organization build and maintain positive relationships with key stakeholders. As part of certain business cases, organizations may need to interact with the government and its legislative or regulatory branches, as well as institutions such as chambers, trade associations, and think tanks. The Institutional Relations strategy allows the company to have a plan of action that helps navigate the complex and ever-changing political, social, and economic environment in which it operates. If needed, it can also influence public policy that may impact the operation or greater industry.

A market and industry analysis compliments the institutional relations strategy in the overall business case. It looks at both internal and external factors. Conducting a thorough market research and opportunity assessment is essential. The objective is to gather all the data necessary to validate the business plan and select the best site for your operation.

- Define the Project – create a presentation of your company background, products and key drivers of the project. Make sure to have an NDA template ready for signature.

- Analyze the Market – identify major players in your industry. Understand the dynamics of their business in Mexico. Identify possible suppliers and map them.

- Analyze the Costs – begin organizing major buckets of costs considering operational, labor and professional services.

- Identify the Risks – consider political, economic, security, natural disasters and other types of risk that could affect business continuity. Identify a mitigation plan.

- Define your Musts/Wants – create a matrix with prioritizations, considering as many project stakeholders as possible (internal and external).

Having mapped the institutional and market landscape, an organization is ready to translate insights into action. Adding operational needs and growth aspirations, the optimal site location must fuel success as well as foster brand presence in Mexico.

– Select Manufacturing Location

– Select Manufacturing Location

The manufacturing site location is a crucial step to The Mexico Journey™. Factors to consider include:

- proximity to raw materials

- transportation infrastructure

- availability of skilled labor

- proximity to target markets

- cost of doing business

Real estate should influence the site selection decision, not drive it solely. There are a lot of players in a real estate transaction. Bringing different areas of expertise and disciplines into the site selection process is important. A need can be framed differently from different operational perspectives: technical, talent development, finance, etc. Integrating a constructibility analysis into the real estate strategy improves the project outcomes including quality and time. It also minimizes potential construction change orders, and aims to create a buildable and biddable construction package.

Infrastructure can significantly impact the implementation of manufacturing operations in Mexico. Below is a generalized map of major gateways (cargo border crossings), railway, seaports, and international airports. Connectivity to the manufacturing operation is important, both from the corporate offices as well as supplier/client facilities.

Additional to transportation infrastructure, its also important to consider that other infrastructure can greatly influence the manufacturing operation in Mexico.

- Industrial Parks– from international firms to local players, these development groups play a pivotal role in the industrial development of different regions. Options range from new, “green” buildings to existing and more basic structures

- Electricity– Mexico’s state-owned company, CFE (Comisión Federal de Electricidad) is the largest generator and distributor of electricity in Mexico. Other firms support the generation of electricity through solar, geothermal, thermoelectric and other technologies. Only CFE can distribute electricity. The rates vary by Mexican state and are adjusted on a monthly basis.

- Natural Gas– Mexico has natural gas infrastructure in most industrial cities. National as well as international companies support the generation and distribution of natural gas.

Water– state-owned companies manage the water and sewer systems in Mexico. The rates vary by state and are adjusted on an annual basis. - Communications– Mexico has very good connectivity with both national and international firms providing voice/data services at competitive costs

For manufacturers doing business in Mexico, an adequate analysis of the market, business case and site selection can provide the foundation for the overall success and sustainability of the operation.

– Setting up a Manufacturing Operation in Mexico

– Setting up a Manufacturing Operation in Mexico

Setting up a manufacturing operation in Mexico involves complying with various legal and regulatory requirements. Navigating the pre-operative phase of a new manufacturing business in Mexico is the fourth step of The Mexico Journey™.

- Operating Structure– depending on the business case, there are a number of ways to structure the manufacturing operation. From a wholly-owned maquiladora or a profit center, to a contract manufacturing or logistics relationship with a service provider. If you sell your product to the Mexican market or need to invoice in Mexico, you will most likely have a profit center operation. A cost center is like a “maquila” operation where the revenue of the finished export will be paid to the parent company.

- Entity Incorporation– if the operating structure requires the incorporation of an entity, consider up to 3 months in your timeline for the process. You will require the (1) Articles of Incorporation, (2) Bylaws, (3) Power of Attorney, (4) Proof of Citizenship, (5) Proof of Residency, (6) Proof of Capital. Additionally, you may need to obtain a tax ID number and an electronic signature required by the tax authority in Mexico (SAT).

The start up of a manufacturing operation depends on many factors. First, the type of operational structure will determine the time required in the incorporation process. Next, different permits are required for construction or land use, international commerce programs and special industries. Lastly, you will need to adhere to local, federal (and in come cases international) compliance in labor, trade operations, health and safety, and day-to-day finance functions.

In a good scenario, a standalone operation can be up-and-running in 6-8 months. Other operational models can reduce this time and streamline the process.

The operative phase of the operations launch transitions from implementation to execution. It involves running the day-to-day business operation in Mexico parallel to production, maintenance, materials, scheduling, quality, inventory, logistics, purchasing, sales and customer service.

Taxation for Mexican Manufacturers

The primary tax requirements for a foreign manufacturing for doing business in Mexico:

- Income Tax: Income tax in Mexico is a federal tax payable at a flat 30% rate for corporations, like a direct tax on the profit obtained. Under certain business conditions. Residents in Mexico, residents abroad with permanent establishment or sources of wealth in Mexico, must make monthly prepayments to the Mexican SAT authority. Transfer pricing regulations control transactions between related companies at the local and international level. The Safe Harbor methodology rules the maquila operations in Mexico. This determines the taxable rate between the higher amount: 6.9% of total value of assets and inventories or 6.5% of the total amount of costs and expenses.

- Value-Added tax is payable at a general rate of 16% on sales of goods and services, imports of goods and lease payments. Some exemptions apply. Taxpayers declare monthly, and can apply for a credit on the surplus VAT paid versus collected.

- Payroll Tax is a state fee paid when carrying out transactions in the company’s labor relations. Monthly payroll tax (2-3%) on labor activities is due to the state Finance Secretary.

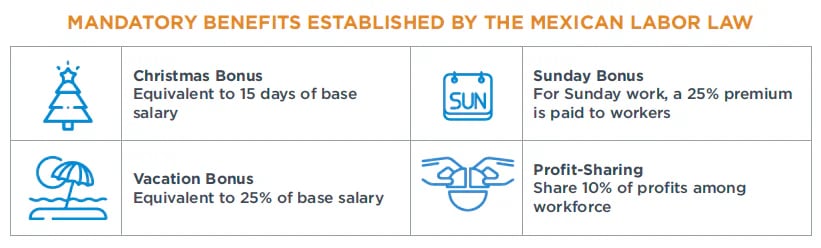

- Profit-Sharing: Employers in Mexico pay workers a share of the profits based on their annual tax declaration. They distribute 10% of the profits before income tax to their workforce. It must be paid within 60 days of the annual declaration of taxes to the authorities.

- Interests, Royalties and Technical Assistance Fees: interests paid to a resident abroad with permanent establishment in Mexico are subject to a withholding tax rate of 4.9% to 35%. Royalties paid to a resident abroad are subject to a withholding tax of 35% and the rate may be reduced with a tax treaty. Technical Assistance paid fees are subject to a 25% withholding tax, unless the tax is reduced with a treaty.

- Property / Real Estate Tax: in Mexico, the acquisition is between 2-4% of assessed value of the property at the moment of the purchase. Then it will be paid annually and is calculated at a fraction of the value of the property.

Tax incentives include: (1) VAT payments on temporary imports through the IMMEX Program (with VAT Certification) and (2) tax credits (VAT and income tax credit) for operating within special zones on Mexico’s northern and southern borders.

Mexico’s employment law protects the rights of workers and promotes social justice in Mexico. In recent years there has been a significant push towards modernizing and updating Mexico’s employment laws to align with international standards and to promote economic growth.

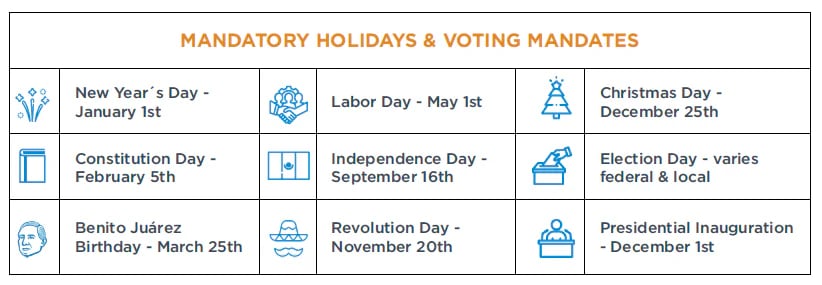

A legal full-time work week in Mexico consists of 48 hours worked, usually divided over 6 labor days, 8 hours each day. A work week consists of 7 paid days, up to 6 of them working days plus 1 rest day per week, with full pay and benefits. There is also a Sunday bonus if required to work on this day. In manufacturing operations, it is common for the plant to run 24/7, or at least have multiple production shifts.

Employee Compensation in Mexico

Employers doing business in Mexico must pay overtime for additional hours worked. They can never force their employees to work overtime. For the first 9 hours of overtime, employees receive their normal payment plus a 100% premium. For the 10th hour and above, employees receive their normal payment plus 200% premium. If an employee works for more than 3 hours of overtime in one day or on 3 separate occasions in one week, the employee earns their normal pay plus 200% premium. There is also a 25% premium for employees who work on Sunday.

Download our Employment Law Summary e-book for free.

Employees are paid weekly for the operative workforce, or biweekly for professional employees. The government sets the minimum wage annually. It is more of a benchmark for fiscal calculations than a market standard wage. Benefits are an important aspect of an employee compensation plan, with most foreign manufacturers paying above minimum mandates. All employees on a payroll are enrolled in Social Security. Its a strong social welfare system that provides medical care, home loans, childcare, disability and retirement benefits.

Manufacturers have to increase the amounts of these benefits to be market competitive, as well as add other benefits to attract and retain their workforce, including: cafeteria services, transportation, daycare, private healthcare insurance, savings fund, food coupons, car allowance, scholarship, etc.

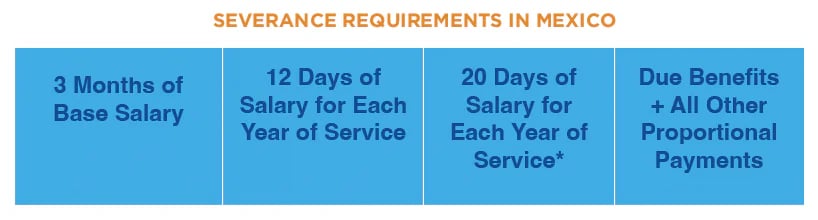

There is no “employment at will” in Mexico. An employer must have just cause to terminate an employment relationship, or otherwise compensate the unjust termination of the contract. In certain cases a severance payment is not required by law (sexual harassment, insubordination, incarceration, alcohol/drug use on premises, etc). In all other circumstances, the employer must pay upon contract termination:

*For employees with more than 15 years of service.

Manufacturers doing business in Mexico, whether national or foreign capital, are taking more seriously their employer brand. Talent dynamics and competition in the nearshoring labor market demand more serious focus on being an Employer of Choice.

The promotion system must be summarized in the Collective Bargaining Agreement with the union (if applicable) and in the internal work rules. Promotions must also take into consideration internal employees first.

In 2019, the Federal Labor Law underwent an overhaul on freedom of association. Employees are in Mexico are free to affiliate to the union of their choice. The employer signs a Collective Bargaining agreement with the union that represents the choice of the majority of the workers, as long as a minimum 30% of workers support it. Additionally, the government rolled out a new labor justice system, creating new pre-judicial conciliation proceedings.

In fact, with the incorporation of Annex 23-A into the USMCA, the Mexican government assumes various obligations, and commits them to law in the Mexican legislation.

International Trade Compliance

The National Customs Agency (ANAM) under Mexico’s Secretariat of Finance and Public Credit (SHCP) is responsible for inspecting goods entering and leaving Mexico. The ANAM has 50 offices throughout the country. It collects duties and taxes on imported goods, depending on the type, value and country of origin. In addition to duties and taxes, other regulations may include import permits, quotas or special licenses.

Import duty rates depend on the HTS Classification Code of goods to be imported. For correct calculation, the import agent must present the import declaration, a commercial invoice, a bill of lading, proof of exemption, and a certificate establishing the origins of the goods. In some cases, you must provide documents that demonstrate the compliance with Mexican product safety and performance regulations. Additionally, sugars and confectionary, beverages and tobacco, dairy and clothing incur a higher customs duty.

Companies may also apply for benefits under a wide range of free trade agreements with 50 countries to get a duty reduction either on importations of raw materials or when exporting finished goods to destination markets. Rules of origin and certification procedures for goods shall be met to obtain these competitive advantages. In the case of the renegotiated agreement between the United States, Canada and Mexico (USMCA), special rules apply to automotive goods. These include regional content calculations, labor content and use of steel and aluminum for producers within North America.

In 2022, the Bill of Lading Supplement became mandatory. This document contains information of the merchandise, locations (origin and destination), as well as the vehicle or the different means of transport. This information is incorporated into an electronic invoice of transfer type or entry with the Bill of Lading Supplement. The transportation issues it and transmits it to the corresponding customs system.

The IMMEX Program in Mexico

The IMMEX Program aims to enable foreign companies to produce goods or provide services from Mexico, in a way that is cost-effective while still focusing on quality. You may have heard of “maquiladoras”. These are factories that import raw material into Mexico, use it in a production or transformation process, and then export it to their home country.

IMMEX companies may secure special registration from Mexican customs authorities to operate as a Certified Company, which grants access to certain benefits. The certified companies framework includes VAT/IEPS Certification, Authorized Economic Operator, Certified Commercial Partner, guarantee of interest payment and the Reliable Importer Program. Individual criteria apply for different program access.

VAT Certification can grant a tax credit on these temporary imports that are destined for subsequent export. They can also temporarily import the raw materials and equipment used in the transformation process without the payment of value-added tax.

There are some requirements, of course. Companies in the IMMEX Program in Mexico have to export at least US$500,000 annually, or at least 10% of their total sales. They must also adopt an inventory control system different from the ERP, comply with time frames for the import and export of their goods, and operate in registered locations in Mexico, among others. Read more about the IMMEX Framework here and here.

Environmental Permits

Backed by the USMCA, Mexico has agreed to reduce its carbon footprint. The government is taking steps to regulate emissions and wastes, as well as protect and conserve the wild flora and fauna. The Federal Congress provides authority to the federal, state and municipal governments which regulate their own jurisdictions.

The Environmental License is one of the most important things to consider when starting a manufacturing operation in Mexico. The submitted study will basically define the environmental impact your operation will have on the air, water, land, etc based on your process residues. It will determine your obligations with the different authorities.

- Construction Permits & Licenses– in Mexico, you need a construction license for most construction projects. Previous to any construction it is important to have a Construction Environmental Impact Assessment. The main studies required for the evaluation include the topography land survey, soil mechanics study and hydrologic study.

- Environmental Due Diligence– the presentation of a Preventative Report and/or Environmental Impact Manifestation. This includes technical studies that describe the environmental conditions before realizing the project. Additionally, you will need a license for land use or change. Companies that generate waste will require a permit as well.

- Service Contracts– a feasibility process is required for setting up utility services in Mexico. It includes the location, type of service requirement, characteristics, etc of the operation. It may take longer if the location requires infrastructure improvements.

- Fire Risk Assessment– the study aims to classify the fire risk of the workplace, and determine the most effective extinction methodologies.

Environmental, Health & Safety Compliance

During the manufacturing operation, there are various reporting requirements, policies and procedures, deviation detection, correction actions development, implementation, mandatory periodic inspections and audits.

- Establish a safety & hygiene mixed commission

- Training and materials handling procedures

- Monthly inspection/audit visit report

- Detect areas of potential risk to the environment and plant personnel

- Monthly compliance reports to authorities

- Execute reporting requirements based on pre-operations permits

- Deploy corrective actions

The Mexican NOMs dictate the operative compliance of the manufacturing facility in Mexico.

Download our EHS Compliance e-book for free.

– Manufacturing Operational Excellence

– Manufacturing Operational Excellence

In today’s dynamic global landscape, North American manufacturers must embrace continual growth to remain competitive and maximize operational results within their broader production networks. Key situations demand growth strategies, and may result in adjustments to doing business in Mexico. This is the ongoing phase of The Mexico Journey™.

- Market Shifts and New Opportunities– evolving customer preferences, technological advancements, and geopolitical trends can open doors to new markets or product lines. Proactive companies can capitalize on these opportunities by expanding their regional footprint, diversifying their offerings, or entering new geographical markets.

- Cost Optimization and Supply Chain Dynamics– rising transportation costs, fluctuating currencies, and supply chain disruptions necessitate ongoing cost optimization. Agility in the supply chain means that companies have a production network that allows them to quickly and effectively adapt to changes in various internal and external factors.

- Technological Integration and Automation– special projects that embrace Industry 4.0 technologies like robotics, data analytics, and automation hold immense potential for efficiency gains and improved quality control.

- Sustainability and Environmental Responsibility– consumers increasingly prioritize eco-friendly practices, and global standards that demand increased focus on social responsibility practices are in constant evolution.

- Talent Acquisition and Workforce Development– attracting and retaining skilled labor is crucial for sustained growth. Being an Employer of Choice in your industry and location is critical to the talent retention needed in today’s competitive labor landscape in Mexico.

Nearshoring: A Boom in Doing Business in Mexico

The USMCA trade agreement positions North America for global competitiveness. Mexico is poised to play an important role in nearshoring. Today, more than $1 million dollars of commercial goods cross the U.S.-Mexico border every single minute. The manufacturing operations in Mexico are strategic to most of the top U.S. manufacturers. A growing number of others rely on their binational operations structure in North America to be competitive in the global market.

Through nearshoring as well as regional expansion, global organizations continue to inject capital into Mexico, elevating its strategic role for global footprints. Doing business in Mexico can be strategic to the growth and competitiveness of many manufacturing organizations.

Download the full e-book “Doing Business in Mexico”.

More than 40 years of experience have ignited our passion: seeing clients succeed in Mexico. Its’s what drives us at Prodensa. That passion fuels The Mexico Journey™, our comprehensive solution designed to seamlessly launch and grow your operations in Mexico. Through project management methodology, we deliver Strategic Advisory, Corporate Planning, Hands-on Support, and more.