In a sector where Mexican customs conduct over 8 million foreign trade operations annually, there's a profession whom has established itself as an essential figure in ensuring the country's competitiveness.

What is a customs broker?

The customs broker is a vital component in the international logistics chain, streamlining the import and export of goods and simplifying the foreign trade process. In Mexico's economy, heavily reliant on international trade—with 83% of the Gross Domestic Product (GDP) linked to it—customs brokers act as essential bridges between the public and private sectors.

Mexico's Custom Offices

Mexico has 50 strategically located customs offices at seaports, borders, and inland regions, including 17 at maritime locations, efficiently managing extensive export and import activities. For instance, in the first half of 2024, maritime customs collected 271.183 billion pesos, accounting for 48.9% of total customs revenue, while border and inland customs contributed the remaining 34%, highlighting the importance of customs brokers in the country's revenue collection and competitiveness.

Innovation in Processes: Technology as a Driver of Efficiency

A key topic to address is the modernization of customs processes in Mexico through technologies such as artificial intelligence and advanced clearance systems. By leveraging these technologies, customs brokers can expedite clearance times and lower costs, benefiting both exporters and consumers.

Chile exemplifies efficient customs processing. At Valparaíso's port, 95% of containers receive advance clearance, facilitating smooth movement to their destinations without port storage. In Brazil, "waterborne clearance" allows customs procedures while containers remain on the ship, reducing port congestion and expediting land transport transfer.

In Mexico, advance clearance is selectively available to companies certified as Authorized Economic Operators (AEO). Though still in pilot stages at some customs offices, these technologies promise to decrease port and customs congestion, enhancing dispatch efficiency.

Challenges in Goods Transit: High Regulatory Costs

Despite Mexico's advancements in technology adoption, regulatory hurdles continue to hinder competitiveness. According to José Antonio Vidales, former president of CAAAREM, the road transit process is excessively regulated, leading to transportation costs that are double those in other regional countries. For instance, shipping freight from the port of Manzanillo to Querétaro incurs significantly higher costs due to customs-imposed guarantees and regulations, compared to the same route outside of a transit process.

At the XXVIII Annual Congress of Shipping Agents, a proposal was made to streamline road transit regulations and promote the use of underutilized inland customs offices. Such measures would alleviate port congestion and lower logistics expenses for importers and exporters. Additionally, it was suggested that advance clearance be extended beyond AEO companies to encompass all operations, with review and control parameters tailored to each company's risk profile. This approach would enable a swifter flow of goods, thereby enhancing industry competitiveness.

Artificial Intelligence and its Impact on Trade Facilitation

Artificial intelligence (AI) and digitalization have emerged as powerful tools for optimizing customs processes. Andrés Ruffo, president of the Association of Customs Brokers of La Paz, highlights the potential of AI in document validation and risk analysis to significantly reduce clearance times and eliminate bottlenecks. AI empowers customs brokers and authorities to perform more precise risk assessments, ensuring that only high-risk operations undergo comprehensive reviews.

Despite these advantages, a major challenge lies in the inconsistent adoption of technology across customs offices. While some offices have implemented digital portals for electronic transactions, others continue to rely on outdated systems that require paper documentation and manual processing. This technological disparity increases logistics costs, delays clearance times, and hinders Mexico's competitiveness in foreign trade.

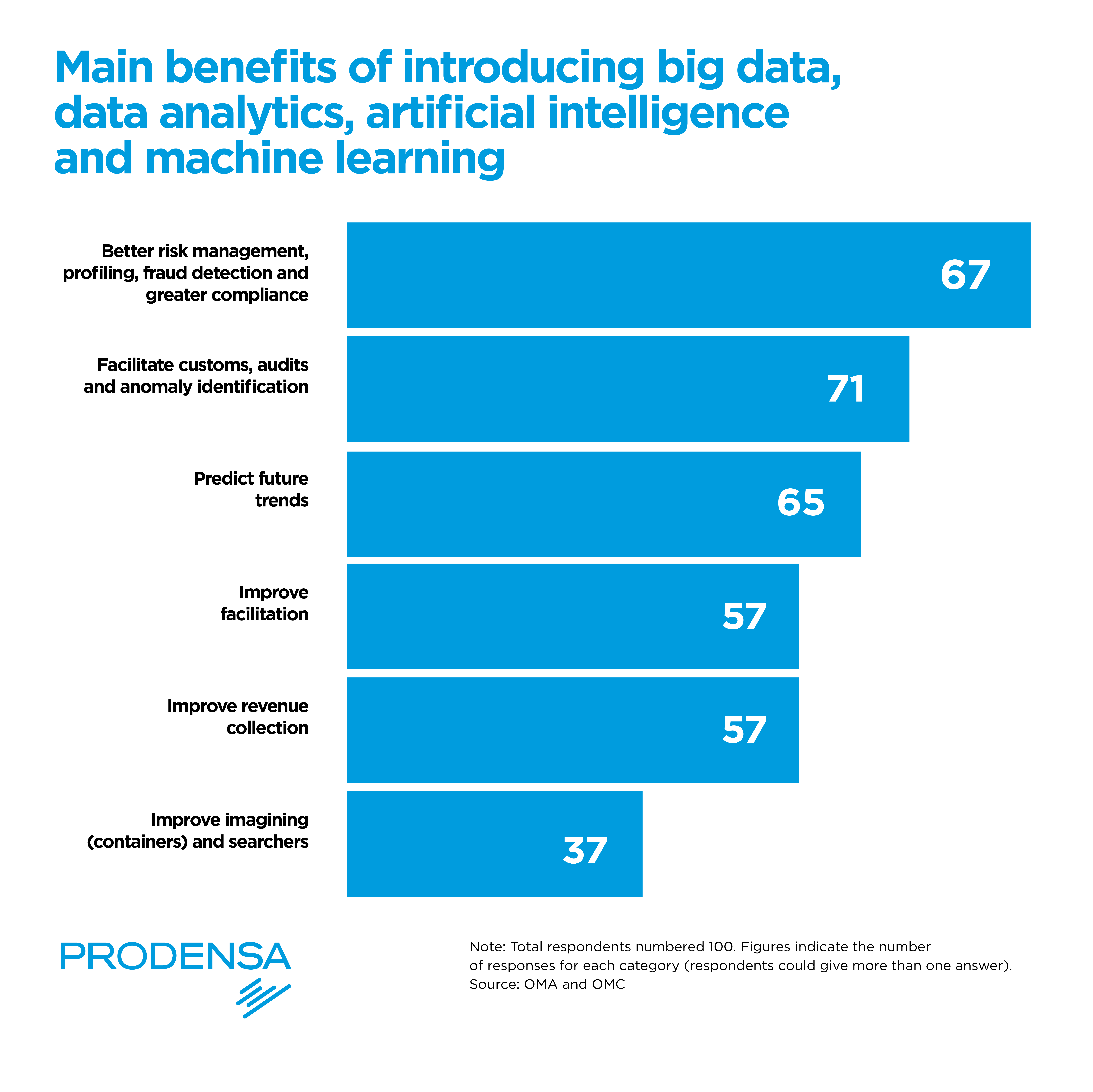

The World Customs Organization's annual survey reports key benefits of AI, such as enhanced risk management and profiling, improved fraud detection and regulatory compliance, more effective customs audits, and better anomaly identification.

Challenges in Implementing New Standards and Proposed Solutions

Numerous customs professionals in Mexico have highlighted a significant challenge: the insufficient communication of rules and regulations prior to their enactment. Excessive regulation and abrupt regulatory changes create uncertainty and complicate the tasks of customs brokers. A proposed solution is for authorities to engage the private sector in the regulatory development process.

Conducting pilot tests before mandating regulations provides authorities with the chance to identify potential issues early and make necessary adjustments. This proactive approach enables a comprehensive evaluation of how the regulations will function under real-world conditions. It ensures the regulations are effective and advantageous for all supply chain participants, including manufacturers, distributors, and consumers.

Do you find yourself analyzing the new trade regulations in Mexico, and need some insights to empower your decisions?

The Future of Customs Brokers

In Mexico, customs brokers transcend mere regulatory compliance, serving as pivotal agents in facilitating foreign trade. They advocate for importers and exporters, playing a vital role in streamlining logistics, cutting costs, and boosting the nation’s competitiveness.

To enhance customs efficiency, collaboration between the public and private sectors is essential. Implementing technological solutions, such as artificial intelligence, and standardizing advance clearance processes are crucial steps. Moreover, increasing the dissemination of regulations and easing road transit restrictions will further bolster Mexico’s global trade competitiveness.

In this interconnected world, Mexican customs brokers have the opportunity to establish themselves as strategic facilitators of foreign trade. By promoting a seamless and secure flow of goods, they contribute significantly to Mexico’s economic growth.

Key Points

- Impact of Foreign Trade on Mexico's GDP: Each year, Mexican customs handle over 8 million foreign trade operations, contributing to roughly 83% of the nation’s GDP. This underscores the critical role of effective customs management in driving economic growth.

- Substantial Customs Revenue: In the first half of 2024, Mexico's maritime customs collected 271.183 billion pesos, accounting for 48.9% of the country's total customs revenue.

- Advance Clearance: A Successful International Solution. In Chile, the port of Valparaíso utilizes the advance clearance system for 95% of containers. This approach enables quicker departures and helps prevent port congestion.

- Elevated Costs from Road Transit Regulations: In Mexico, road transit expenses are almost twice those of regular freight because of stringent regulations and guarantee demands.

- Mexico’s 50 Key Customs Offices: Mexico boasts 50 strategically placed customs offices across seaports, borders, and inland regions, including 17 situated at maritime locations.

![Aduanas-BLOG[AD1]](https://www.prodensa.com/hs-fs/hubfs/Aduanas-BLOG%5BAD1%5D.png?width=1584&height=396&name=Aduanas-BLOG%5BAD1%5D.png)