The medical device industry in Mexico is a fast-growing manufacturing sector, yet many opportunities exist for further investment, growth, and consolidation.

Global Medical Device Industry Overview

The medical device industry is expected to reach US$612.7 billion dollars by 2025. It is driven by a global market of increased chronic illness and cancer cases, as well as a higher focus on novel technologies and the growing adoption of home care devices.

.webp?width=638&height=416&name=Picture1%20(1).webp)

The United States continues to lead the global export market (18.8%) and the import of medical devices for domestic use (20.14%), according to combined statistics from OEC.world. Mexico, the top exporter of medical devices of Latin America, is well-suited to continue supplying this top market.

Mexico´s Medical Device Industry

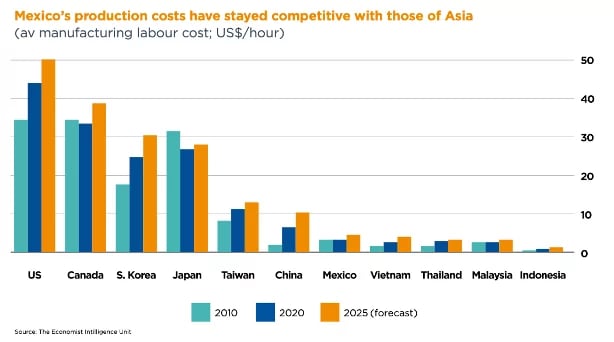

Mexico is the 8th largest global manufacturer of medical devices and is currently the top exporter of medical devices to the United States. Over the past years, many important companies have reshored medical device operations to North America, creating over 20,000 jobs in 2020 throughout the region. Mexico is poised to take on a larger share of manufacturing due to its stable and competitive manufacturing costs.

In fact, many of the top medical device companies call Mexico home: Medline, Medtronic, Johnson & Johnson, Philips, GE Medical Systems, Siemens, Smiths Medical, Cardinal Health, Becton Dickinson, Abbot Laboratories, and Stryker Corp, to name a few. Low-cost manufacturing and a prime geographical location are only some of the reasons why. Mexico´s talent in the medical device sector is growing every year.

Medical Device Talent in Mexico

In the midst of a global pandemic, Mexico stepped up to the plate. According to the Mexican Association of Innovative Medical Devices (AMID), pandemic-related medical device output increased 5-20 times to meet global demands. In fact, one leading company in Mexico producing ventilators and face masks saw a 181% growth in hirings since 2020, just in the first semester of 2021 alone.

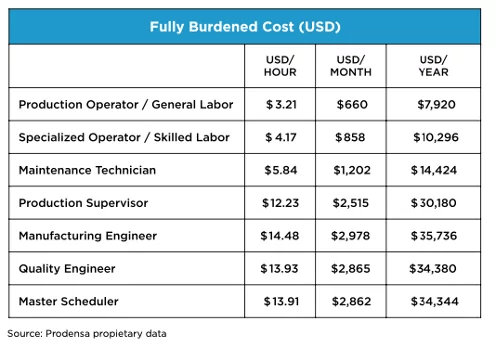

The medical device industry in Mexico employs over 150,000 workers. In the 2019-2020 academic year, over 140,000 students graduated from careers related to medical device manufacturing, according to combined data from ANUIES. The medical device industry offers competitive salaries and benefits for Mexican employees and represents major cost-savings for many global manufacturers.

Opportunities for Mexico

Many opportunities still exist for the Mexican medical device industry. A consolidated public health system in Mexico with over 50% import for domestic consumption represents a large gap for national manufacturers to fill.

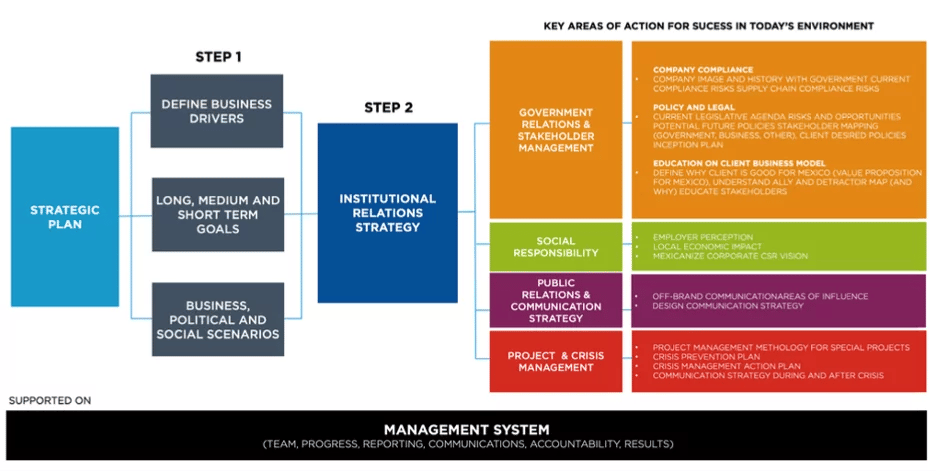

Business challenges in infrastructure, political landscape, the rule of law, compliance, and regulation are being met with initiatives to fight corruption and train for the use of more advanced medical devices for domestic consumption.

The key to successful institutional relations in Mexico is the alignment of a value proposition to the federal administration´s overarching goals. Corporations in Mexico should seek a sustainable future in an ever-changing and growing market. Being relevant is key to navigating the current socio-economic environment and taking advantage of market opportunities.

About Prodensa

Prodensa is a Mexican advisory and project management firm with 35 years of experience supporting companies in Mexico – from strategic advisory and startup support of new operations to ongoing compliance, talent development, and business continuity consulting. Over 1,000 international corporations have trusted their Mexican operations to our local experts.

About the author

Robin Conklen, Commercial Director.

Originally from the United States, Robin Conklen has been collaborating with Prodensa since 2012, leading different business development strategies and specializing in Mexican talent costs and culture.

Supporting the advisory services of Prodensa, Robin shares insights and best practices for competitive manufacturing operations in Mexico, including site selection for specific talent needs, implications of cultural differences, turnover costs, and retention programs.

Robin is dynamic and leads the investigation and analysis of research-based programs and market trends, transforming big data into best practices for Prodensa clients seeking a productive and profitable workforce in Mexico.