Over the past thirty years, Mexico's port system has experienced a significant transformation. Following the enactment of the 1993 Ports Law, which enabled the establishment of Comprehensive Port Administrations (APIs), the nation has evolved from a rudimentary port infrastructure to a dynamic and competitive system, buoyed by substantial private investment.

Today, Mexico's port terminals serve not only as hubs for cargo and maritime traffic but also as vital connectors in both national and regional logistics networks, enhancing competitiveness. We consulted industry experts to explore the strategic importance of these terminals and examine how their challenges and opportunities are shaping the future of Mexican trade.

A Brief History of Port Terminals in Mexico

The modern history of ports in Mexico began in 1993 with the enactment of the Ports Law, a key moment that allowed private capital participation in port terminals. Before this reform, the Mexican port system was primarily made up of the ports of Veracruz and Tampico, which operated under practices and standards that limited their growth and efficiency. The introduction of APIs enabled the creation of commercial entities to manage ports, facilitating private investment access without the need to sell public assets.

Today, Mexico has 63 port terminals across 18 strategic ports, where 82% of the investment is private, while the federal government provides the remaining 18%. This model has been highly successful, but it faces significant challenges. Sustained growth in demand, technological changes, and increased maritime traffic demand resilient and efficient infrastructure to maintain the country’s competitiveness in the global trade landscape.

*TEU is "twenty-foot equivalent units", a commonly used description of cargo capacity.

The Role of Terminals in the Logistics Ecosystem

Port terminals are integral components of a broader logistics ecosystem, encompassing land transportation, customs, shipping lines, and freight forwarders. Beatriz Yera, General Director of APM Terminals Mexico, emphasized the critical role of terminal efficiency in regional and national competitiveness. She noted, "Inefficiencies at a terminal impact not only customers but the entire logistics ecosystem." Delays or failures in terminal processes can cause disruptions across the supply chain, affecting everything from delivery times to consumer costs.

A recent incident underscored this vulnerability: Hurricane John halted operations at Pacific ports for about 90 hours, highlighting the logistical system's susceptibility to natural disasters. This situation underscores the urgent need for collaboration between terminals and other stakeholders to bolster port infrastructure resilience in emergencies.

Challenges in Port Infrastructure

Mexico's port terminal infrastructure is robust yet constantly challenged, particularly in its ability to respond to external events. Beyond natural disasters, the increasing size and capacity of ships pose persistent challenges. Trends in maritime trade indicate a rise in vessel scale, necessitating terminals capable of handling massive cargo loads.

One significant issue is storage capacity, which occasionally becomes saturated. We spoke with Manuel Fernández Pérez, General Director of SSA Marine Mexico, who highlighted the crucial need to adapt port infrastructure to accommodate anticipated growth in the coming years.

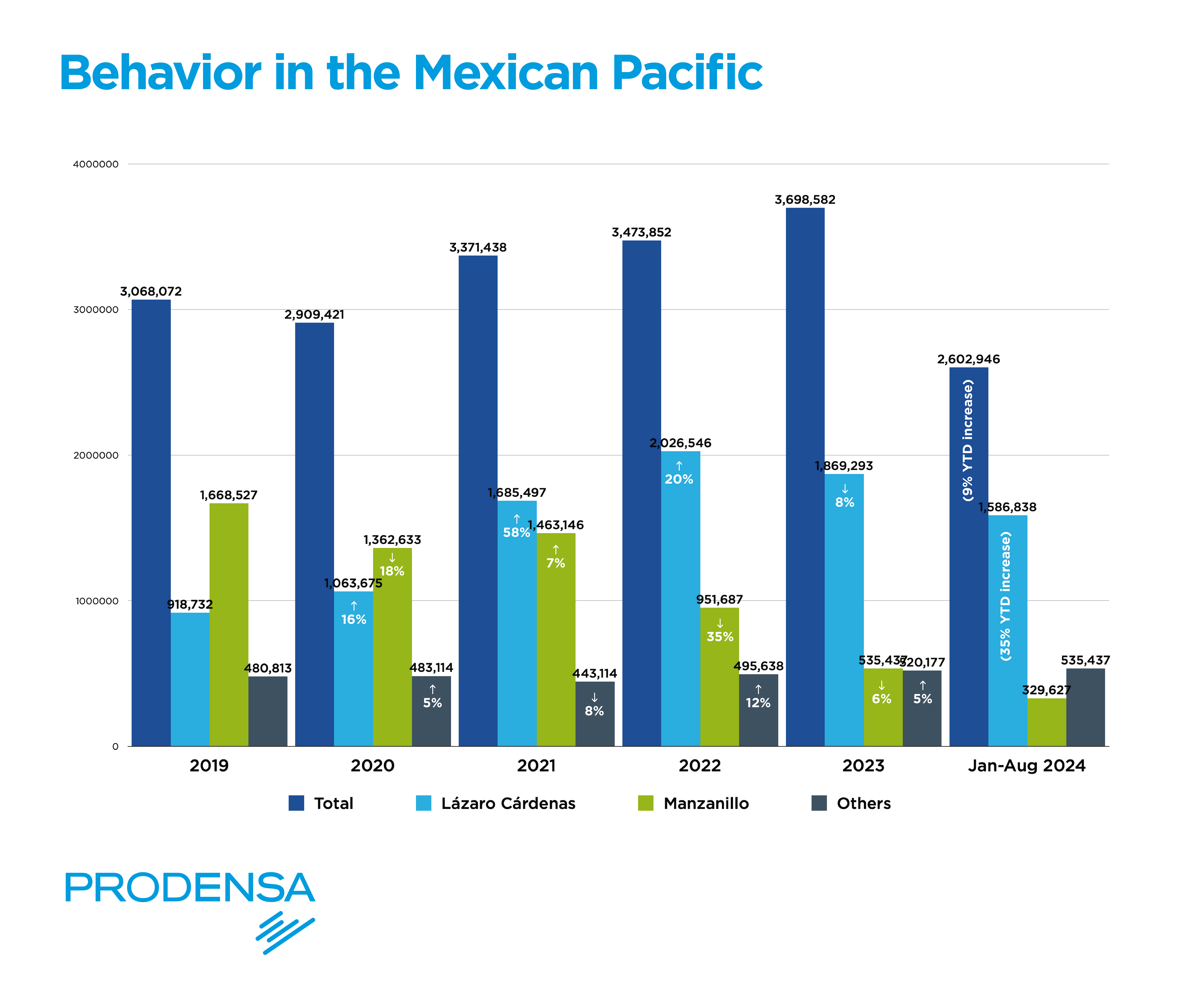

Statistics show that the port of Lázaro Cárdenas experienced a 35% increase in cargo volume over the past year, while Manzanillo saw a 10% rise. Although terminals may appear to have capacity on paper, operational realities reflect peak-hour saturation, affecting ship waiting times and overall efficiency.

Towards a Resilient and Efficient Port Ecosystem in Mexico

To address these challenges and improve efficiency, Mexican terminals are making substantial investments and incorporating advanced technology. APM Terminals, for instance, is doubling the capacity of its terminal in Lázaro Cárdenas, with completion expected by February 2026. This expansion will help manage growing cargo volumes while reducing waiting times and enhancing storage capacity. Additionally, investments in automated yards, digital infrastructure, and energy-efficient equipment are optimizing response times to natural disasters and streamlining cargo handling.

Achieving maximum efficiency also requires close coordination with government authorities. Customs digitalization and automation are essential to reducing clearance times and improving trade security. Francisco Orozco, Commercial Director of Hutchison Ports in Mexico, emphasized to us that a shortage of customs personnel and manual processes create bottlenecks in cargo flow. Operating customs 24/7 at high-traffic ports like Manzanillo and Lázaro Cárdenas, along with stronger coordination between port and customs authorities, could significantly reduce costs and wait times, advancing Mexico’s logistical efficiency.

The Challenge of Sustainability

Sustainability is another major challenge and opportunity for Mexican port terminals. As the world moves toward cleaner energy, Mexican terminals are exploring ways to reduce their carbon emissions. APM Terminals has begun implementing green energy technologies, such as solar panels and low-emission equipment, in its operations.

Beatriz Yera also commented on the importance of investing in technology to reduce the carbon footprint and support the country’s energy transition. For future generations, she noted, it is imperative for the port industry to adopt sustainability measures that not only benefit the environment but also position Mexico as a country committed to the green economy.

Key Points:

- Strong Operations: Mexico operated 40 commercial ports that moved 294 million tons of cargo, attending 29,791 ships in 2023.

- Essential Private Investment: 82% of investment in Mexican port terminals is private, fundamental to the sector’s modernization and expansion.

- Resilient Infrastructure: Natural disasters and increased traffic demand prepared terminals and robust infrastructure to ensure continuous operations.

- Digitalization and Efficiency: Customs automation and 24/7 operations are necessary to reduce costs, clearance times, and improve competitiveness.

- Sustainability as a Priority: The transition to clean energy and green technology in terminals drives competitiveness and reduces environmental footprint.

- Public-Private Coordination: Collaboration between authorities and the private sector is key to strengthening the logistics ecosystem and tackling global trade challenges.