DO THE NEW VARIABLES SUPPORT YOUR CURRENT OPERATION?

Read more about the impact of COVID-19 in Mexico and the challenges it has generated for the industry.

In this newsletter, you will find the latest information about the current situation, and recommendations to mitigate the risk of your operation.

Stay calm, keep your eye on the ball, be consistent.

You can do this!

For further information contact us: contact@prodensa.com

RISK MITIGATION

Tips to mitigate your risk by Kurt Schmidt

Kurt Schmidt is an expert in international turnaround and crisis management. Kurt has transcendental know-how on manufacturing operations. He creates solutions, he creates value.

- Cashflow

- Plan with a minimum of 13 weeks of visibility.

- Create critical milestones and readjust your cashflow.

- Sales – receivables, etc.

- Review of your insurance policy

- Do you have business interruption coverage?

- Be proactive no re-active

- Build your mitigation plan

- Let your mind go to cover all angles.

- Surround yourself with “out of the box Tinkers”, they can show you a different perspective. If you don´t have them internally seek externally.

- Communicate your plan with the team, everybody needs to know what the company is up against.

- Cash is King, spend it wisely.

- Identify your key resources

- Create 3 levels within your organization.

- Evaluate your supply chain strategy

- Plan how to get back to our original 2020 plan, can you recover? What adjustment can you make to get back on track?

The ability to see the problem from different angles is key!

Crisis management is required where suddenly the old system can´t support the new variables.

Stay calm, surround yourself with “out of the box Tinkers”, consistently work thru the issues, YOU CAN DO THIS!

CONTINGENCY INCENTIVES COVID-19 IN MEXICO

These are the economic plans to face the crisis by COVID-19 in Mexico. The following States have offered support packages:

Nuevo Leon

- Creation of a trust fund of $1 billion pesos: the government will contribute $600 million pesos, $160 million pesos will be contributed by decentralized agencies and it is intended to have the mayors to guide more than $200 million pesos of the infrastructure fund.

- 100% remission of water and drainage payments.

- Support of 100 inspectors to go to companies and support the compliance of health standards.

- Discounts on the payment of the property.

State of Mexico

- Distribution of $1.6 billion pesos in support of more than 800,000 families

- Support will be sought for people in conditions of food poverty, children, women, and the elderly.

Aguascalientes

- Creation of an economic fund.

- Injection of resources into public financing systems with flexible interest rates.

- Reformulation of social support programs so that they have greater amounts.

- Implementing tax write-offs on local taxes.

Sonora

- In the months of March and April, there will be a 50% discount on the payment of payroll taxes for companies with 50 employees or less, a 100% discount on the payment of Hotel Tax, an extension for payment of vehicle revalidation and alcohol licenses, a 50% discount on the payment of registration fees for the registration of housing and the suspension of state control acts.

- There will be 1.3 billion pesos that will seek to support preferably local contractors.

Hidalgo

- Emergency insurance for positive workers of COVID-19 with support of $3,750 pesos (1st. Month).

- Credit line for micro, small and medium businesses (3-month payment extension, zero rates)

- 50% of the payroll tax payment (March – April for micro, small and medium enterprises).

- -Tourism and services sector:

- 100% of the tax for the provision of accommodation services is extended (period March – April)

- Suspension of programmed actions of inspection in state contributions for companies in Hidalgo.

- Public works are not stopped (health controls are strengthened to protect construction workers).

San Luis Potosi

- SLP Government announces a $3.2 billion contingency package for COVID-19.

- The plan is divided into four areas: fiscal incentives to protect the productive sector and employment; economic support for affected people and productive sectors; infrastructure and government purchases; and social and food support.

- The deadline for payment of the payroll tax is extended from March to July.

Coahuila

- Extension of the 5% discount on the Property Tax until June 30, 2020 (the discount originally ended on March 31, 2020)

- 30% discount on the Tax on the Exercise of Mercantile Activities, Tax on Toilet Services and Tax on Transit and Transportation Services.

- 80% discount on the Tax for Issuance of Licenses, Permits, Authorizations and Environmental Control Services (including vehicle verification)

- 40% discount on the Tax on the Occupation of Public Roads.

- 85% discount on the Tax from the Lease of Premises Located in Municipal Markets.

- 50% discount on the payment of fees generated by the 2020 advertising licenses and on the payment of fees generated by the 2020 operating licenses.

Guanajuato

- Credit program, to support entrepreneurs and MSMEs, through Funds.

- Interest reimbursement program.

- Extension for the payment of the Tax on Payrolls corresponding to April and May, to be covered, without surcharges, from July 2020.

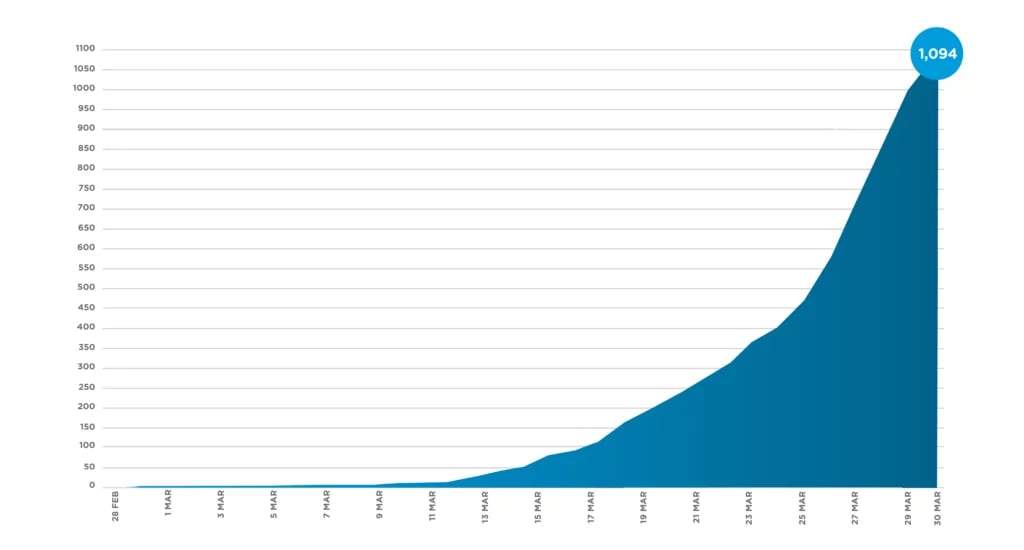

COVID-19 PROGRESSION IN MEXICO, MARCH 2020

This is the information about the COVID-19 situation in Mexico by numbers. We present you the detailed progression during the month of March.

- 1,094 confirmed cases.

- 101 new cases reported at the end of the month

- 2,752 suspicious cases.

- 4 cases with no symptoms.

- 90% have been non-serious and only 10% have required hospitalization.

- 28 deaths.

Distribution of deaths per state:

Mexico City (8), Jalisco (3), Hidalgo (2), SLP (2), Coahuila (1), Durango (1), State Mex (1) Michoacan (1), Morelos (1), Oaxaca (1), Puebla (1), Queretaro (1) Quintana Roo (1), Veracruz (1) and Sinaloa (3)