The Mexican aerospace industry has experienced remarkable growth in recent years, solidifying its position as a key player in the global aviation market. However, with this growth comes increased complexity in international trade regulations. To ensure compliance and maintain a competitive edge, aerospace companies manufacturing in Mexico must stay abreast of the latest trade policies, tariffs, and export controls.

The Mexican Aerospace Industry

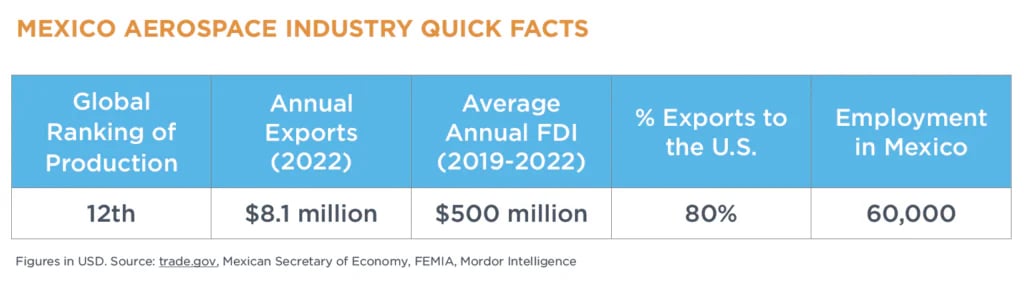

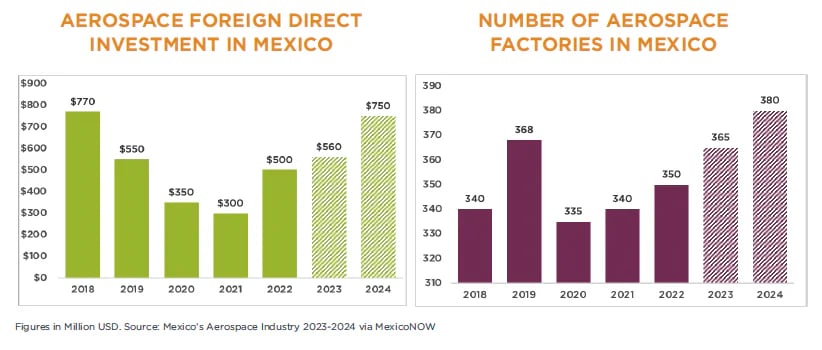

The aerospace industry has contributed significantly to the nation’s economic growth, job creation, and technological advancement in recent years. Over the past two decades, Mexico has strategically positioned itself as a significant player in the global aerospace market.

Overall, the industry comprises suppliers that manufacture parts and components for the commercial, civil, and private transport sectors. The Mexican transport sectors currently account for 29% of Mexican exports and approximately 3.5% of the national Gross Domestic Product. The aerospace industry in Mexico directly employs over 60,000 workers. In total supports 1.4 million workers throughout related industries in Mexico.

The aerospace industry is the most dynamic sector in Mexico, with 14% sustainable growth over the past 15 years.

Download the free Aerospace Industry in Mexico e-book.

Mexico offers foreign manufacturing companies incentives and export programs to operate in the country. The sector is projected to continue its growth path.

Trade Compliance for Aerospace Companies

The Mexican government's programs can notably lower import costs in the aerospace sector, especially for exported goods' manufacturing materials or components. It's particularly significant for steel and aluminum products. Duties saw an increase from 0% to 25% following an August 2023 presidential decree.

IMMEX Program in Mexico

The IMMEX Program is a duty-deferral license for the manufacturing and maquila industry including import-export. It covers the industrial processes or services intended to manufacture, transform or repair foreign goods temporarily imported that are subsequently exported or to provide export services.

This program also provides a special income tax regime for pure maquila (cost centers) or shelter companies by applying a safe harbor provision and preventing the principal company abroad to be considered as permanent establishment in Mexico. It is authorized by the Ministry of Economy.

Value-Added Tax Certification

Value-Added Tax Certification. The VAT program is designed for IMMEX companies by granting a credit line that authorizes not paying the VAT for materials or components at the time of importation with the condition of exporting a finished good within the time frame allowable. It is granted by the Tax Administration Service.

Manufacturing Certificate

Manufacturing Certificate. - The “Constancia de Manufactura” is an authorization allowing manufacturers, subcontractors producing aircrafts, aircraft engines, propellers to take advantage of duty reductions by applying a single tariff classification for raw materials on their imports. It is issued by the Ministry of Infrastructure, Communications and Transportation.

Conclusion

In order to retain the licenses offered by the Mexican government, companies must meet stringent requirements. These include regular inspections at manufacturing sites, frequent report submissions on various areas such as income, expenses, imports/exports, employee count, and production projections. Moreover, it's crucial for companies to maintain a robust inventory control system for all temporarily imported goods, in line with customs regulations.

PRODENSA is a consulting and project management firm that specializes in support foreign manufacturing companies operating in Mexico. In the area of International Trade Compliance, we are currently supporting 5 aerospace clients with their international trade compliance in Mexico.

Currently acting as Foreign Trade Manager for PRODENSA, I bring over 15 years of experience in international trade in Mexico, including 9 years in the Mexican tax authority specializing in Authorized Economic Operator and VAT/IEPS Certification.

.png?width=2362&height=993&name=FirmasCorreo-36%20(1).png)