Explore the comprehensive resources of the US-Mexico border economy, trade boom, transportation infrastructure, and cross-border collaboration. Download the full ebook in PDF.

The Rise of Cross-Border Manufacturing

The roots of the cross-border manufacturing boom trace back to the Maquiladora Program, implemented in the 1960s. This program allowed foreign firms to establish factories in Mexico and import materials duty-free. These are then assembled and exported back. The program’s evolution into the IMMEX program expanded the opportunity by allowing a wider array of goods to be produced.

Nearly 60% of today’s maquiladora (or IMMEX) operations are along the US-Mexico border zone. The IMMEX industry employs about 3 million workers (2022) with about 35% of the country’s manufacturing jobs in the sector. IMMEX companies pay about 40% more, on average, than manufacturers that are not in the export sector.

Read more about the History of Manufacturing in Mexico.

The US-Mexico-Canada Agreement

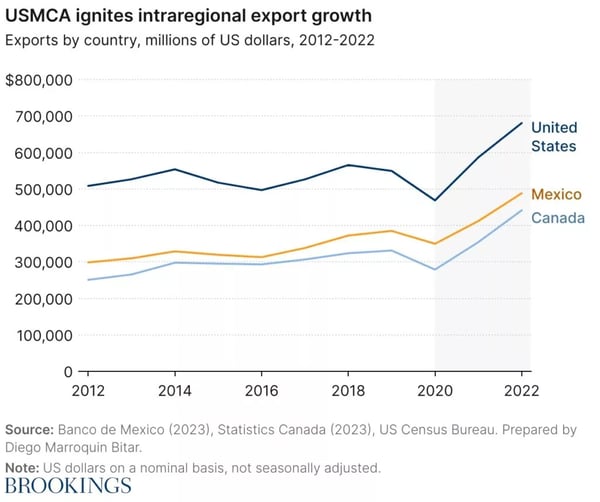

Further propelling this trade growth was the signing of the North American Free Trade Agreement (NAFTA) in 1994. It eliminated many tariffs and boosted cross-border trade. Economists largely agree that NAFTA benefited North America’s economies. Regional trade increased sharply over the treaty’s first two decades, from roughly $290 billion in 1993 to more than $1.1 trillion in 2016. Cross-border investment also surged. US foreign direct investment (FDI) stock in Mexico increasing in that period from $15 billion to more than $100 billion.

The recent transition from NAFTA to the United States-Mexico-Canada Agreement (USMCA) has further solidified the trade relationship. It added modern provisions to address 21st-century trade challenges and opportunities. The last three years have witnessed remarkable progress in expanding trade, investment, and employment. The goal is that the USMCA generates positive outcomes for workers and the broader society across North America.

Moreover, USMCA has established a stable policy environment and baseline for North America. It makes it an attractive platform for developing comprehensive supply chains in sectors such as electric vehicles (EVs) and semiconductors, tackling climate change and fostering clean energy, and expanding access to critical minerals.

These strategic initiatives have played a significant role in shaping the thriving US-Mexico trade landscape we witness today.

Dive deeper into the strength of North American talent.

Key Drivers to Cross-Border Manufacturing

The rise in US-Mexico cross-border manufacturing has been fueled by trade agreements and incentive programs, as well as a cultural shift and infrastructure improvements. Robust economic ties between the US and Mexico, exemplified by Mexico becoming the US’ top trading partner in 2019, underscore the significant impact of these strategic initiatives on enhancing cross-border manufacturing.

Several key factors contribute to the success of cross-border manufacturing and trade between the United States and Mexico. Additional to foundational support like trade agreements, incentive programs and infrastructural developments, other factors play a role in the success of cross-border manufacturing:

.webp?width=792&height=810&name=Picture1%20(2).webp)

These elements combined have both strengthened economic ties and boosted the competitiveness of North American industries on the global stage. Companies that conduct business in the US-Mexico border zone should expect a unique environment and challenges to binational manufacturing.

The Future of the US-Mexico Border

The future of the US-Mexico border region is being shaped by several factors. New US legislation is incentivizing manufacturing’s return and growth for economic and security reasons. Border states are attracting manufacturing investments for specialized processes, leveraging tax breaks, training programs, and business-friendly initiatives to entice companies to bring back key supply chain components, utilizing Mexico’s manufacturing sector.

Nearshoring and reshoring trends are bringing more manufacturers to the border region, strengthening an interconnected network of manufacturing facilities. Many experts predict an increase of this connected ecosystem of manufacturing, assembly, testing, packaging, warehouse, and logistics facilities as companies strive to optimize their supply chains. Both countries have been upgrading transportation infrastructure to support cross-border trade, and this infrastructure must evolve to meet ESG goals.

The US-Mexico Border

The unique environment along the US-Mexico border is characterized by a fluid, dynamic exchange of goods, services, and people. This region is a crucial gateway for commerce between North America and the rest of the world. As such, it serves as an essential link in global supply chains and plays a crucial role in economic growth.

.webp?width=600&height=452&name=Picture2%20(1).webp)

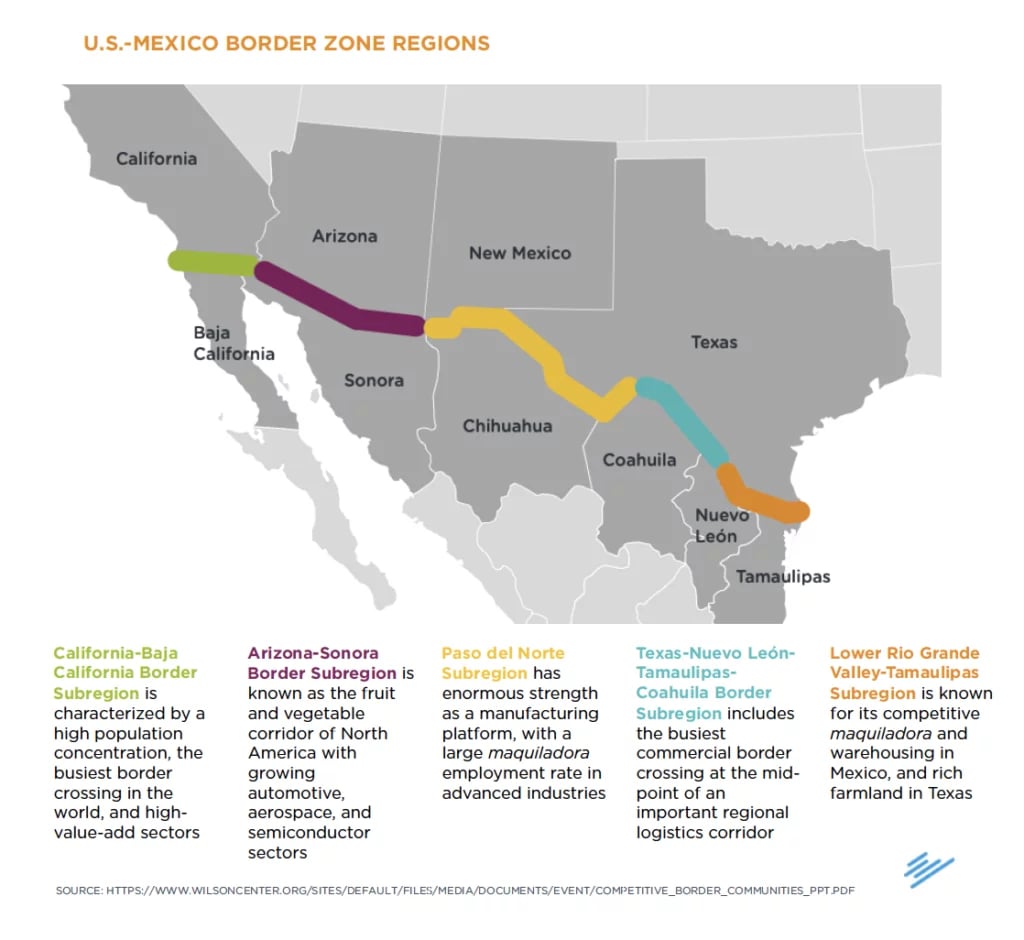

The Wilson Center Mexico Institute describes the US-Mexico border as “characterized by sister-city pairs engaged in a long-term process of forming five “mega-regions” whose principal economic pillars include large-scale joint production and advanced manufacturing, among other activities.” In their recent “Competitive Border Communities” white paper, the Wilson Center defines 5 distinct border regions:

US-Mexico Border Zones

The US-Mexico border is marked by a robust and intricate network of connectivity and infrastructure, designed to support the immense volume of goods and people crossing daily. Key infrastructure components include a collection of land ports of entry, highway networks, and railway systems. Land ports are connected via an expansive highway network that spans across various states, serving as the main arteries of trade. The rail systems also play a significant role, especially in transporting bulky and heavy goods over long distances.

Digital connectivity is equally crucial, enabling seamless coordination between stakeholders involved in cross-border trade. This integrated physical and digital infrastructure significantly bolsters the region’s trade capacity, fueling economic prosperity on both sides of the border.

This intricate infrastructure underscores the importance of collaboration between institutions on both sides of the border. Research indicates that a mere 10-minute reduction in border wait times could generate an additional $26 million worth of cargo entering the United States each month. Mexico purchases 16% of U.S. exports, often utilizing them in a transformation process and returning the finished goods to the United States for consumption. This binational understanding of the importance of cross-border connectivity and collaboration is a testament to its vital role in fostering economic growth and prosperity.

US-Mexico Relationship

The United States and Mexico maintain a relationship of cooperation and mutual understanding. This helps overcome some of the major challenges associated with the development of border crossing projects. The timelines and authorizations on both sides of the border must be very precise, including funding. Regular communication helps facilitate the processes. Testing and oversight from both sides is key to the continued alignment of connectivity operations.

Within the 2022 infrastructure law contributes $3.4 billion to modernization of 26 land ports of entry, 6 of which fall along the U.S.-Mexico border. Mexico pledged an additional $1.5 billion in border infrastructure over the following two years. A joint statement between the nations read, “the joint effort seeks to align priorities, unite border communities, and make the flow of commerce and people more secure and efficient”.

The bill aims to battle ongoing challenges from aging infrastructure, lack of security, landlocked ports, increased traffic, migration, and more.

Insights from US-Mexico Border Manufacturers

Things on the border have moved from “just in time” to “just in case” where they storing more on the U.S. side of the border, because they are less certain they can cross at a moment’s notice like before the pandemic.

Some goods certainly are moving more, if not faster. The Mexico Institute reports that since the transition from NAFTA to USMCA in July 2020, the value of two-way agricultural trade shot up by 44% from $50.86 billion in 2019 to $73.14 billion in 2022.

The US-Mexico border sees a migratory influx of 300,000 people every year, of which about 80% stay in the cities along the northern border region of Mexico. The Customs & Border Protection has closed some official crossings under recent strains.

Closures and increased inspections have led to massive delays for cargo vehicles waiting to cross into the United States. In both Mexico and the United States, the supply chain bottlenecks are causing economic damage and production disruptions. The United States has also seen delayed delivery of goods, creating a backlog of shipments, and a suspension of production due to a lack of available storage space.

The US-Mexico border situation is expected to be an integral topic in the 2024 elections, both in the United States and Mexico, fueling political tensions. If Mexico and the United States fail to successfully adjust border operations to account for elevated migration, disruptions could continue or increase.

The Nearshoring Boom

The USMCA positions North America for global competitiveness, and Mexico is poised to play an important role in nearshoring. Manufacturing operations located in Mexico are strategic to most of the top U.S. manufacturers. A growing number of others rely on their binational operations structure in North America to be competitive in the market.

An Investment Boom in Mexico

Over the past years, there has been a great shift from offshoring US manufacturing operations to bringing them closer to home through a process known as nearshoring. This trend has been particularly strong in Mexico. The country offers many advantages such as its proximity, cost-effective labor force, and trade agreements. Nearshoring was on the lips of many executives during third quarter earnings calls, and in the first six months of 2023, Mexico raked in around $29 billion in foreign direct investment, up 5.6% from 2022. Notably, the $5 billion Tesla factory has been accredited with over $1 billion in Chinese investments in nearby industries.

Made in the USMCA

Supply chains in North America are heavily intertwined and interdependent. The total value of trade within North America exceeded $1.5 trillion in 2022, equal to $3 million per minute. Intermediate goods are those passed back and forth between North American countries’ supply chains that are components for final products that are made within the same region. The value of the trade in intermediate goods supports 9.5 million jobs across North America (Brookings USMCA Tracker). Manufacturers in the region can benefit from cost-savings through process efficiency and improved product quality.

Collaborative US-Mexico Manufacturing Experts

Where previously Mexico has been solely known for its cheaper manufacturing inputs that can more squarely compete with overseas competitors, the relationship continues to evolve. Today, the spotlight is on Mexico’s increasingly skilled workforce, a high degree of supply chain connectivity, and improved infrastructure and technological advancements. Collaboration between the North American manufacturing workforce goes beyond physical production. Engineers, designers, and technical experts from the three countries often collaborate on product development, innovation, and process improvement. This collaboration allows companies to tap into the strengths of each workforce, combining expertise and knowledge to drive efficiency and competitiveness.

In Conclusion

The US-Mexico border is not just a physical divide but also a source of collaboration, innovation, and economic prosperity for both nations. As we continue to navigate through challenges and work towards enhancing cross-border connectivity, it’s crucial to recognize the importance of cooperation and mutual understanding in achieving common goals for North America.

This blog post summarizes the e-book “The US-Mexico Border Boom: a Look into the Thriving Cross-Border Manufacturing Industry” available for free download. Written by Robin Conklen, Managing Director USA @ PRODENSA

References

Sources used in the elaboration of this e-book (alphabetical):

- The Americas face a historic opportunity: will the region grasp it? (2023) The Economist

- Arizona-Sonora Border Master Plan (2022) by Arizona Department of Transportation

- Bipartisan Infrastructure Law Construction Projects (2023) by U.S. General Services Administration

- Building the Cross-Border Economy: Local Leadership in the Arizona-Sonora Megaregion (2022) by Arizona Mexico Commission

- The Cali-Baja Regional Economy: Production, Employment, Trade & Investment (2022) by the University of San Diego Knauss School of Business

- California-Baja California Border Crossings and Trade Data (2023) by San Diego Association of Governments

- Competitive Border Communities; Mapping and Developing U.S.-Mexico Transborder Industries (2015) by Wilson Center

- Factors Influencing Cross-Border Cooperation in North America (2023) by Mary Fiagbe, Major Papers. 235.

- International Trade Corridor Plan (2022) by Texas Department of Transportation

- Mexico’s Foreign Affairs Statistics (2023) by Mexican Embassy

- NAFTA’s Economic Impact (2023) by Council on Foreign Relations

- Neareshoring Drives Demand in U.S.-Mexico Industrial Real Estate and Infrastructure Markets (2023) by Macquarie Group

- Redefining and Governing the Border Binational Commons (2023) by Baker Institute for Public Policy

- San Diego-Calexico Border Region Economy (2022) by San Diego Chamber of Commerce

- Smart Border Coalition: About the Border (2023) by Smart Border Coalition

- The Southern Border Region at a Glance (2023) by Alliance San Diego

- Supply Chain Sustainability (2022) by EY

- The Economic Impact of a More Efficient U.S.-Mexico Border (2022) by Atlantic Council

- The United States-Mexico-Canada Agreement (USMCA) (2023) by Office of the United States Trade Representative

- U.S.-Mexico Border: Trade and Transportation (2015) by Site Selection Magazine

- U.S.-Mexico Trade and Transportation Infrastructure Study (2019) by North American Development Bank

- US-Mexico Border Transportation Master Plan (2022) by Texas Department of Transportation

- US-Mexico Border Transportation Master Plan Executive Summary (2022) by Texas Department of Transportation

- USMCA at 3: Reflecting on Impact and Charting the Future (2023) by Brookings Institution

- USMCA Tracker (2023) by Brookings Institution

- USMCA: Legal Text (2023) by USTR

- US-Mexico Border Transportation Master Plan – Lower Rio Grande Valley (2022) by Texas Department of Transportation

- US-Mexico Border: Commodity Flows between the United States and Mexico through Arizona Border Ports of Entry (BPOEs) (2023) by Eller College of Management, University of Arizona

- U.S.-Mexico Relations (2023) by U.S. Department of State

- US-Mexico Trade: A Folklife Perspective (1993) by Smithsonian Institution