Mexican Labor Law Expert

- Vice President of Human Resources at PRODENSA

- National Director of Labor Relations at INDEX

- VP of Labor, Social Security, & HR Committee at CONCAMIN

- CONASAMI Employer Representative

- Former Electoral Board at National Electoral Institute

- Weekly LABORAtorio Opinion Column in El Norte

OVERVIEW OF REPSE IN MEXICO

What is REPSE?

REPSE, or the Registry of Providers of Specialized Services or Specialized Works, is a governmental registry in Mexico. It was introduced in 2021 to regulate subcontracting practices and ensure labor law compliance under the Federal Labor Law in Mexico.

Purpose of REPSE

The primary purpose of REPSE is to combat illegal subcontracting, protect workers' rights, and ensure fair labor practices. By registering with REPSE, companies demonstrate their commitment to legal and ethical standards.

The REPSE Framework

The Federal Decree related to Labor Outsourcing, published April 23, 2021 involved key regulatory bodies in Mexico, including:

- Federal Labor Law (Ley Federal del Trabajo)

- Social Security Law (Ley del Seguro Social)

- Law of the National Workers' Housing Fund Institute (Ley del Infonavit)

- Federal Fiscal Code (Código Fiscal de la Federación)

- Income Tax Law (Ley del Impuesto sobre la Renta)

- Value Added Tax Law (Ley del IVA)

- Federal Law of State Workers (Ley Federal de los Trabajadores al Servicio del Estado)

- Regulatory Law of Section XIII Bis of Section B, Article 123 of the Constitution (Ley Reglamentaria del Apartado B del Artículo 123 Constitucional)

These bodies, through the reform published on April 23, 2021, regulate labor outsourcing practices in Mexico.

Understanding REPSE

The REPSE (Registro de Prestadoras de Servicios Especializados u Obras Especializadas) was introduced as part of a significant labor reform in Mexico that took place in 2021, with the goal of regulating outsourcing and ensuring better protection for workers. Its background is rooted in previous outsourcing practices that led to widespread abuse of labor rights and avoidance of employer responsibilities.

History of Outsourcing in Mexico

- Widespread Use: Prior to the 2021 reform, outsourcing or subcontracting labor had become common in Mexico. Companies often outsourced core functions to third-party contractors as a way to reduce costs, evade responsibilities such as paying taxes, social security, and employee benefits, and avoid adhering to labor rights protections.

- Labor Law Gaps: Although outsourcing was regulated under earlier laws, many companies took advantage of legal loopholes. This led to widespread non-compliance with Mexico's labor, tax, and social security laws. Outsourced workers often had precarious employment conditions, lacked job security, and were excluded from profit-sharing benefits (known as PTU).

Abuse of Worker Rights

- Avoidance of Benefits: Many companies used outsourcing to reduce labor costs by evading employee benefits such as healthcare, pensions, severance pay, and profit-sharing. Workers who were subcontracted had fewer rights than those hired directly.

- Employment Instability: Employees under these outsourcing schemes often faced job insecurity, with limited opportunities for career growth and benefits, as they were technically employed by third-party firms instead of the companies they worked for daily.

Discover More about REPSE

The 2021 Labor Reform in Mexico

- Objective: To address the widespread abuse of outsourcing, the Mexican government enacted a sweeping labor reform in April 2021. This reform primarily focused on regulating outsourcing practices and ensuring that workers receive their full labor rights.

- New Restrictions on Outsourcing: The reform banned the outsourcing of core business activities. This means that companies could no longer outsource work that directly aligned with their primary economic activities. Only specialized services or works that were not part of the main business could be legally outsourced.

Creation of REPSE

The introduction of REPSE reflects Mexico's effort to curb outsourcing abuses and strengthen labor rights. It helps ensure companies are compliant with the law, offering transparency, improved labor conditions, and fair treatment for workers across all industries. This move represents a shift towards more responsible and transparent outsourcing practices, with the government playing a more active role in regulating labor compliance.Types of REPSE

The REPSE distinguishes between two main types of specialized service providers under the country's updated labor laws. The classification of REPSE is based on the nature of the services or works being offered:

Companies offering specialized services not related to the core business of the contracting company. Specialized services are often defined as those that require technical knowledge, equipment, or resources that the hiring company does not possess internally. Examples: IT consulting, maintenance services, legal advisory, etc.

Entities providing specialized works that require specific expertise, equipment or physical tasks outside of the company's main operations Examples: construction of facilities, specialized repair or remodel, installation or specialized machinery, etc.

List of REPSE Activities

Some of the common specialized service areas include:

How to Apply for REPSE in Mexico

Applying for REPSE in Mexico involves a detailed process to ensure compliance with the labor reform.

The required documentation for REPSE registration includes proof of compliance with tax and social security obligations, financial statements, and detailed descriptions of the specialized services or works offered.

- Corporate name and taxpayer identification number (RFC)

- Proof of compliance with tax obligations - obtain a "Constancia de Situación Fiscal" from Mexico's Tax Administration Service (SAT) that certifies your tax status is in order

- Proof of compliance with Social Security obligations - ensure that you are up-to-date with payments to the Mexican Social Security Institute (IMSS) and the National Workers' Housing Fund (INFONAVIT)

- Certificate of registration with the Mexican Business Information System (SIEM)

- List of specialized services or works including the necessary industry codes (example NAICS)

- Evidence of financial solvency, example financial statement

Key Impacts of REPSE

The introduction of REPSE as part of Mexico’s 2021 labor reform has had significant effects on businesses operating in the country.

REPSE COMPLIANCE IN MEXICO

REPSE Compliance for Companies

Manufacturing and other types of companies often require specialized services that can be categorized under the REPSE regime. REPSE registration is required when contracting services that fall under specialized activities—those that are not part of your company’s core business operations. Failing to comply can lead to severe penalties, including fines and potential contract terminations.

By hiring specialized services with REPSE, the company is co-responsible for the compliance of Social Security payment. This means that if the service provider does not adhere to social security or labor regulations, the contracting company may also be held liable. There are also additional risks for fines and legal consequences if proper certification and registration are not in place when specialized workers are present on-site at your facility in Mexico. Inspections by the Mexican labor authorities could trigger investigations into both the service provider and the hiring company, leading to legal complications and even suspension of business activities if found non-compliant.

Frequently Asked Questions

REPSE certification is required for any service you hire that requires external personnel to be on-site at your business. These activities cannot be classified as the same activity of your own core business; that is still banned. But complementary activities that you need to hire must be accompanied by a REPSE certification. For example, a e-commerce company in Mexico can hire specialized services with REPSE for data entry and inventory management activities.

To deduct expenses related to services provided by specialized service firms (registered under REPSE), the hiring company must verify that the service provider is registered in the REPSE database. Failure to comply with this requirement may render the expenses non-deductible for tax purposes. Companies must meet documentation and reporting obligations to ensure tax deductibility. Further, the process for VAT recovery requires additional documentation like REPSE registration proof as well as service contracts.

Case Study: Ensuring Compliance in Hiring Specialized Services in Mexico

As part of our Consulting practice, PRODENSA has robust experience in supporting purchasing departments in Mexico navigate their REPSE compliance. These obligations help maintain the relationship with service providers, ensure compliance with Mexican labor laws, and avoid legal risks.

- Verification of REPSE Registration of Service Providers - includes validating their registration number and ensure their services are classified as specialized and distinct from the core business of our client in Mexico

- Labor Subcontracting Agreements - review the contracts of specialized service providers in Mexico to ensure they remain compliant. They must detail the scope of the services as well as the responsibilities of both parties. These contracts will be registered in the electronic systems developed by IMSS.

- Payroll and Employee Benefits Compliance - verify that the specialized service provider is making the necessary contributions for the employees working on the manufacturing site, including Social Security and INFONAVIT

- Tax Compliance - verify VAT payments and keep detailed records of invoices

- Income Tax Withholding - confirm the service provider correctly withholds the correct amount for the employees

- Compliance with Labor & Safety Laws - confirm the provider adheres to all labor laws including health & safety regulations, union and collective bargaining agreements inside the manufacturing facility

- Reporting to STPS - verify receipt of filing the necessary labor reports to the STPS

REPSE Compliance for Providers

Once registered, REPSE suppliers of specialized services are required to maintain compliance with all tax, social security, and labor laws. This includes filing regular reports on your operations and ensuring that you remain up-to-date with IMSS, SAT, and INFONAVIT payments. Failure to maintain compliance can result in fines, de-registration from REPSE and legal penalties.

- Record-Keeping Requirements - REPSE holders must maintain accurate and up-to-date records of their operations, including contracts, invoices, and payment records.

- Reporting Obligations - Regular reporting to the relevant authorities is mandatory, detailing the specialized services or works provided, employee information, and compliance with labor laws.

- Audits and Inspections - REPSE holders are subject to periodic audits and inspections to ensure ongoing compliance with regulatory requirements.

- Penalties for Non-Compliance - Non-compliance with REPSE regulations can result in severe penalties, including fines, suspension of operations, and revocation of REPSE registration.

REPSE Compliance Risks

Any person or company that provides specialized services without the REPSE certification from STPS is subject to various risks.

- Payment - the invoices submitted related to specialized services will no longer be valid

- Taxes - The specialized service provider will be subject to limitations on the deductions and credit of the taxes paid.

- Fine - The fine for not having a compliant REPSE in Mexico is outlined in Article 1004 of the Federal Labor Law, and defines penalties up to $5,428,500 pesos.

- Cancellation - In case that the specialized service provider does not comply with legal obligations, they are at risk for cancelation of the REPSE registration. They will advise the corresponding authorities from IMSS; SAT and INFONAVIT. Once cancelled, they will notify the clients related to the legal entities registered to deliver the specialized services.

Case Study: Ensuring Compliance in Providing Specialized Services in Mexico

As a company providing specialized services to global manufacturers operating in Mexico, PRODENSA has to adhere to several compliance requirements. These obligations ensure that we have a good standing with government authorities as well as our clients, many of whom are part of domestic as well as international trade programs.

- Payroll and Employee Benefits Contributions – each month we must be prepared to submit paperwork to clients hiring our Specialized Services, including Social Security payments, INFONAVIT contributions, and payroll tax payments.

- Tax Compliance – submit the monthly tax report to the Mexican SAT, detailing the value-added tax (VAT) and income tax (ISR) withheld from employee salaries

- Employee Payroll and Benefits Reporting – submit a detailed report reflecting the correct calculations of employee wages, deductions and taxes to the relevant government bodies

- Labor Compliance and Record-Keeping – ensure all employee contracts are compliant with Mexican labor laws and correctly identify whether they are providing specialized services or working on core business functions of the client

- IMMEX & Trade Compliance (if applicable) – if the specialized services fall under IMMEX or involve handling of imported goods, ensure that all import/export declarations are in line with the programs’ requirements

- Labor Outsourcing and Reporting to STPS – submit reports to the Ministry of Labor and Social Welfare (STPS) detailing the number of employees, services rendered and any contractual changes with clients

- Client Compliance and Contracts – ensure all client contracts clearly outline specialized services and that these services do not overlap with the “objeto social” or business classification of the core activities

- Preparation for Audits – maintain readily available the documentation needed for possible audits or inspections by government authorities whether the SAT, STPS or IMSS.

REPSE RENEWAL PROCESS

The REPSE certification is good for 3 years. Since its implementation in 2021, the expectation during 2024 is that 89,735 REPSE certificates will need to be renewed, according to the Secretary of Labor and Social Security. The renewal process must be processed three months prior to the date of expiration of the REPSE.

The Ministry of Labor and Social Welfare (STPS), through the platform, must respond to the renewal request within 20 (twenty) business days of receiving the application.

Required documents:

- Proof of compliance with fiscal and social security obligations from SAT, IMSS and INFONAVIT

- Realize the renewal process during the 3 months prior to the expiration date of REPSE

- Update information and documentation utilized for the initial registration

- Verification of activities

REPSE RENEWAL CALENDAR

| Registration Year | Month of Certification | Renewal Dates |

| 2021 | June | March - May 2024 |

| July | April - June 2024 | |

| August | May - July 2024 | |

| September | June - August 2024 | |

| October | July - September 2024 | |

| November | August - October 2024 | |

| December | September - November 2024 |

| Registration Year | Month of Certification | Renewal Dates |

| 2022 | January | October - December 2024 |

| February | November 2024 - January 2025 | |

| March | December 2024 - February 2025 | |

| April | January - March 2025 | |

| May | February - April 2025 | |

| June | March - May 2025 | |

| July | April - June 2025 | |

| August | May - July 2025 | |

| September | June - August 2025 | |

| October | July - September 2025 | |

| November | August - October 2025 | |

| December | September - November 2025 |

Common Challenges & Solutions

Common challenges related to REPSE often arise from its complex legal, regulatory and administrative requirements.

- Defining "Specialized Services" - many services lie in a gray area, but it is not advantageous to register without need

- Maximum Benefits - the maximum limit of profit-sharing was increased to 3 months of salary

- Authorities - The primary authority responsible for overseeing REPSE compliance is Mexico’s Ministry of Labor and Social Welfare (STPS). However, other authorities may be involved, depending on the nature of the audit: IMSS, SAT, INFONAVIT

- Audits cover: employee registration, wages and benefits, work conditions, tax compliance, social security compliance, REPSE registration and service contracts

- Audit Process: informed or surprise notification of audit, possible on-site visit to the workplace, review of documentation, potential interviews of employees or management

- Monthly Reporting - After registration, companies must submit monthly reports to prove compliance with tax, labor, and social security obligations. Failing to provide timely or accurate information can lead to penalties or suspension from the registry.

- Invoicing - all transactions and invoices must align with the VAT and REPSE regulations, including properly documented services rendered and compliance with SAT standards

- Constant Monitoring of Service Providers - Companies must continuously monitor their service providers to ensure they remain REPSE-certified and compliant. Even small lapses in compliance can lead to contract terminations or legal consequences.

- Supreme Court Ruling - the highest court has ruled that demanding proof of specialization as a mandatory requirement for obtaining a REPSE is unconstitutional

- Repeal of VAT Retention - elimination of the 6% VAT withholding on subcontracting, replaced with reporting requirements. The process for VAT recovery for REPSE expenses involves additional documentation.

REPSE Solutions

Our team is a respected authority on human resources regulation for manufacturers in Mexico, including REPSE.

PRODENSA Provides Specialized Services in Mexico

Features:

- Full & strict compliance with registration and book keeping

- National coverage in Mexico

- Multiple solutions to support manufacturing & business operations

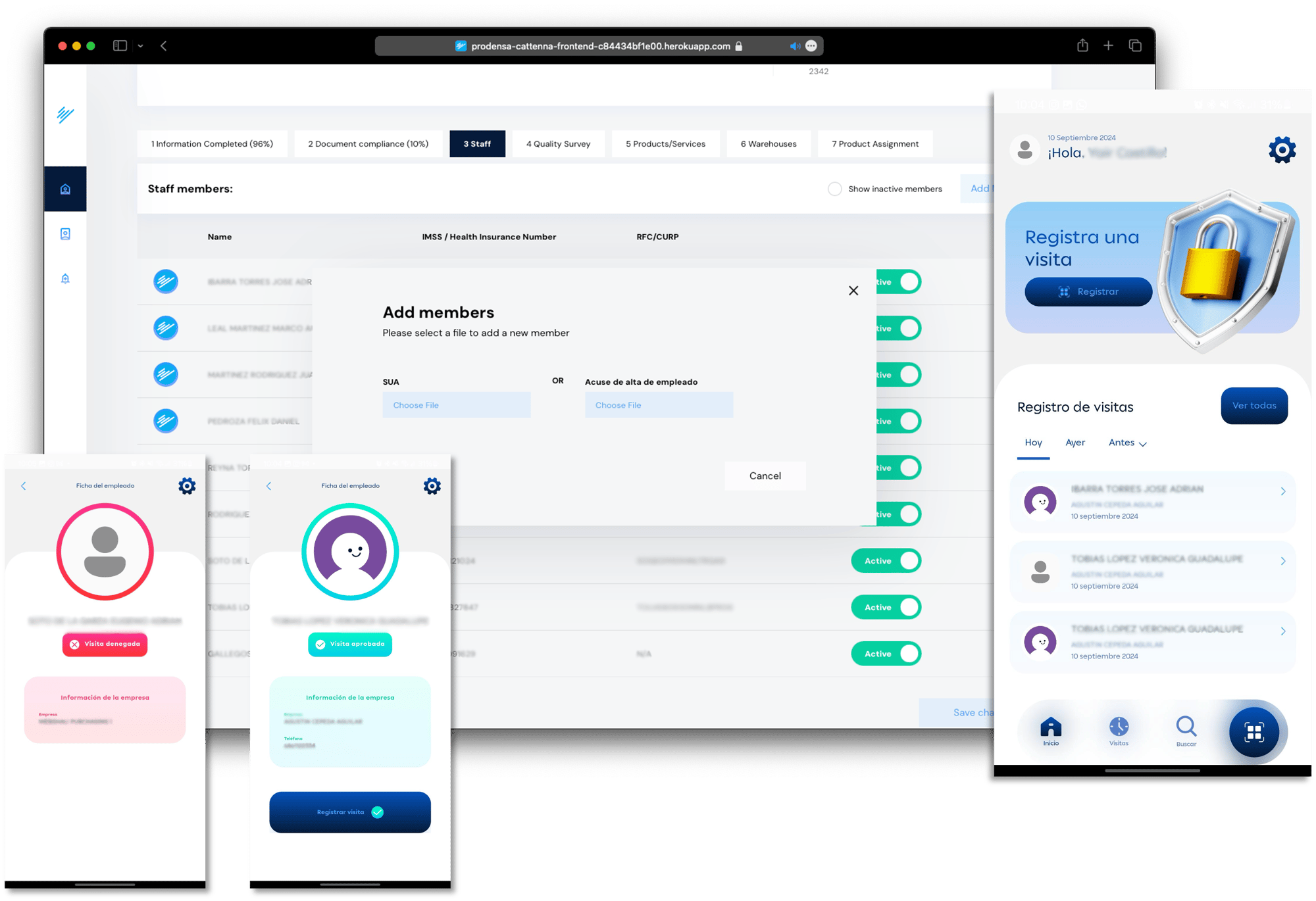

REPSE Compliance Portal

Cattenna Business Solutions

Mitigating risk and ensuring REPSE compliance for your suppliers in Mexico.

- Mobil access for on-the-go access codes and control record

- Automated validation of supplier documentation

- Dashboard for streamlining an on-site visit from authorities