TABLE OF CONTENTS

The Mexico Journey™

Our insignia solution.A customized approach for launching manufacturing operations in Mexico.

MANUFACTURING IN MEXICO

Through a project management methodology, our customized approach to manufacturing in Mexico.

That's The Prodensa Way.

The legal frameworks in Mexico are constantly evolving. The Mexican Constitution is the supreme law of the land. It holds the highest authority. The Mexican Constitution establishes basic principles of government. It includes more than 2,600 federal, state and local laws and regulations. Some of these include the Federal Civil Code, the Federal Criminal Code, the General Law of Commercial Companies, and the Federal and Commercial Code.

Mexico has a legal system known as Civil Law, and it is very formal and bureaucratic. The notary public office in Mexico holds a lot of weight and responsibility. For foreign companies, this will most likely require a power of attorney and partner to facilitate.

Foreign investors can own 100% of a Mexican corporation, although certain industries may have restrictions. There are two main types of corporations in Mexico: (1) sociedades anónimas (SA’s) which are similar to U.S. corporations, and (2) sociedades de responsabilidad limitada (SRLs) which are similar to LLC’s in the United States.

Mexico is a federal republic and the president is elected to a six-year term. There is no reelection.

As part of certain business cases, organizations may need to interact with the government and its legislative or regulatory branches, as well as institutions such as chambers, trade associations, and think tanks. The Institutional Relations strategy allows the company to have a plan of action that helps navigate the complex and ever-changing political, social, and economic environment in which it operates.

A market and industry analysis compliments the institutional relations strategy in the overall business case. It looks at both internal and external factors. Conducting a thorough market research and opportunity assessment is essential. The objective is to gather all the data necessary to validate the business plan and select the best site for your operation.

Having mapped the institutional and market landscape, an organization is ready to translate insights into action. Adding operational needs and growth aspirations, the optimal site location must fuel success as well as foster brand presence in Mexico.

Factors to consider include proximity to raw materials, transportation infrastructure, availability of skilled labor, proximity to target markets, and cost of doing business. Other influencing data includes: direct labor local dynamics, talent retention specific to site location, public transportation, evaluation of customer/customs activity on site, etc. Finally, in alignment with cultural factors, the approach to Mexican institutions and business associates in reference to properties, incentives and pricing is fundamental to the success of the negotiation.

Real estate should influence the site selection decision, not drive it solely. There are a lot of players in a real estate transaction. Bringing different areas of expertise and disciplines into the site selection process is important. A need can be framed differently from different operational perspectives: technical, talent development, finance, etc. Integrating a constructibility analysis into the real estate strategy improves the project outcomes including quality and time. It also minimizes potential construction change orders, and aims to create a buildable and biddable construction package.

Setting up a manufacturing operation in Mexico involves complying with various legal and regulatory requirements. Navigating the pre-operative phase of a new manufacturing business in Mexico is the fourth step of The Mexico Journey™.

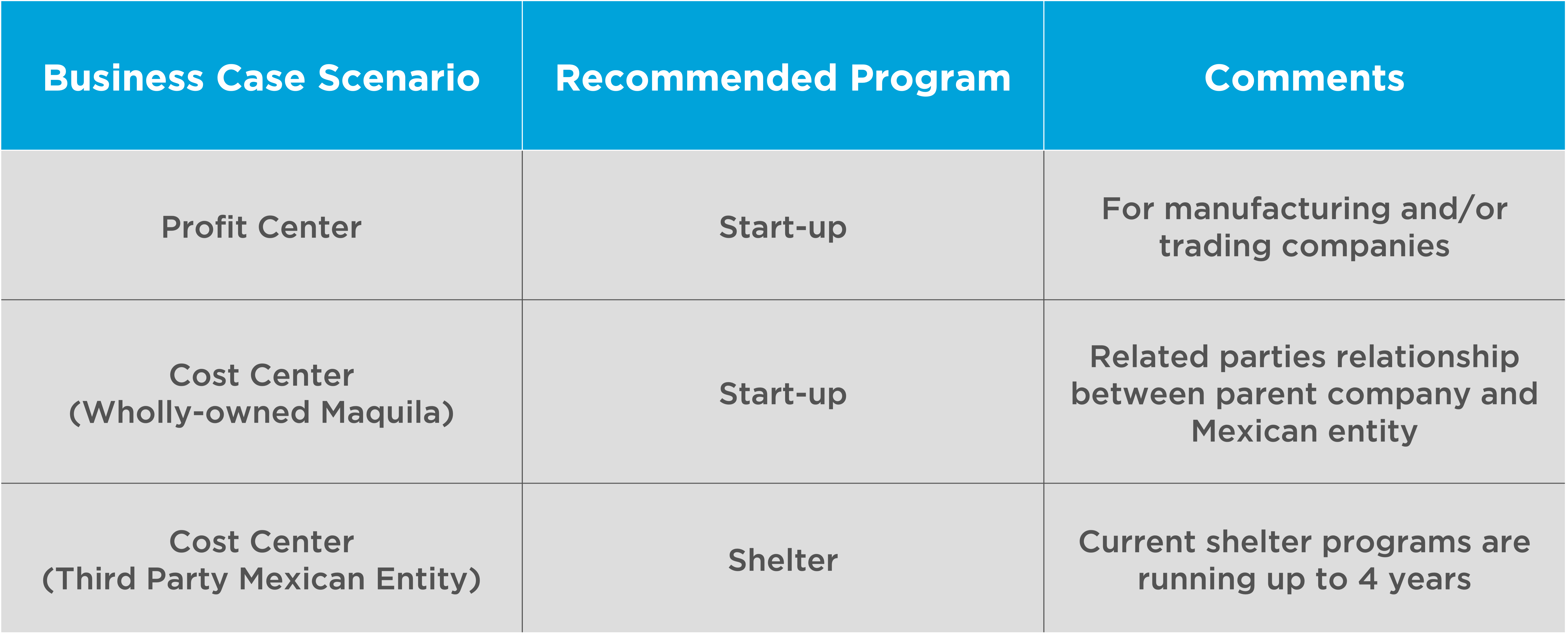

Operating Structure– depending on the business case, there are a number of ways to structure the manufacturing operation. From a wholly-owned maquiladora or a profit center, to a contract manufacturing or logistics relationship with a service provider. If you sell your product to the Mexican market or need to invoice in Mexico, you will most likely have a profit center operation. A cost center is like a “maquila” operation where the revenue of the finished export will be paid to the parent company.

Entity Incorporation– if the operating structure requires the incorporation of an entity, consider up to 3 months in your timeline for the process. You will require the (1) Articles of Incorporation, (2) Bylaws, (3) Power of Attorney, (4) Proof of Citizenship, (5) Proof of Residency, (6) Proof of Capital. Additionally, you may need to obtain a tax ID number and an electronic signature required by the tax authority in Mexico (SAT).

In today’s dynamic global landscape, North American manufacturers must embrace continual growth to remain competitive and maximize operational results within their broader production networks. Key situations demand growth strategies, and may result in adjustments to doing business in Mexico. This is the ongoing phase of The Mexico Journey™.

- Market Shifts and New Opportunities– evolving customer preferences, technological advancements, and geopolitical trends can open doors to new markets or product lines. Proactive companies can capitalize on these opportunities by expanding their regional footprint, diversifying their offerings, or entering new geographical markets.

- Cost Optimization and Supply Chain Dynamics– rising transportation costs, fluctuating currencies, and supply chain disruptions necessitate ongoing cost optimization. Agility in the supply chain means that companies have a production network that allows them to quickly and effectively adapt to changes in various internal and external factors.

- Technological Integration and Automation– special projects that embrace Industry 4.0 technologies like robotics, data analytics, and automation hold immense potential for efficiency gains and improved quality control.

- Sustainability and Environmental Responsibility– consumers increasingly prioritize eco-friendly practices, and global standards that demand increased focus on social responsibility practices are in constant evolution.

- Talent Acquisition and Workforce Development– attracting and retaining skilled labor is crucial for sustained growth. Being an Employer of Choice in your industry and location is critical to the talent retention needed in today’s competitive labor landscape in Mexico.

Your Navigator-in-Chief

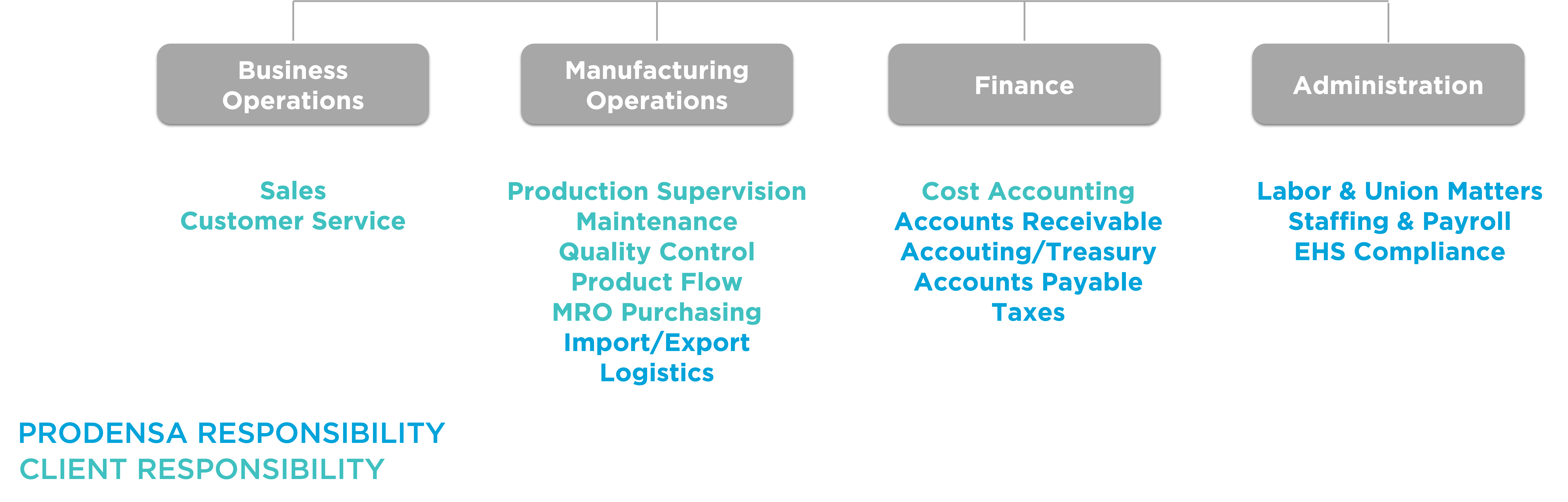

Our material experts are industry leaders, continuously honing their knowledge through participation in professional associations and community engagement. Collaborating with a network of multi-disciplinary professionals gives us the cutting edge in the dynamic new era of trade.Operation Structures

- Dedicated Shelter Model

- Profit Center Domestic

- Profit Center Export

- Structure Comparison

- Responsibilities

NON-MAQUILA DOMESTIC SALE OF GOODS IN MEXICO

NON-MAQUILA EXPORT SALE OF GOODS OUTSIDE OF MEXICO

Dive deeper into the models here.

Your Navigator-in-Chief

Our material experts are industry leaders, continuously honing their knowledge through participation in professional associations and community engagement. Collaborating with a network of multi-disciplinary professionals gives us the cutting edge in the dynamic new era of trade.

Manufacturing in Mexico

Different Models for Different Business Plans

- Mindfacturing®

- Contract Manufacturer

- Inshoring

- Shelter

- Wholly-Owned Maquila

- Toll Manufacturing

- Contract Manufacturing

- Full-Fledged Manufacturing

- Full-Fledged IMMEX

- Trading Company

INSIGHTS

Manufacturing in Mexico: the Food & Beverage Industry

EV Automotive OEM Assembly in Mexico Report

Start ReadingChanges to the Landscape of Annex 24 in Mexico

DOWNLOAD THE MANUFACTURING IN MEXICO START-UP CHECKLIST

An overview of manufacturing in Mexico, including operational structures, trade programs, taxes and the important milestones for a successful operations launch.

MANUFACTURING IN MEXICO - A START UP CHECKLIST

An overview of manufacturing in Mexico, including operational structures, trade programs, taxes and the important milestones for a successful operations launch.