Manufacturing in Mexico has been the industrial driver for economic growth in Mexico. It continues to compel the development of key talent that has become the cornerstone for North American competitiveness.

An Integration Region

The North American economies are intertwined as well as dependent. In fact, $0.40 cents of content imported to the United States from Mexico is actually produced in the United States, from production materials to cloud services. The path forward has to be based on a clear understanding that the U.S. are strategic partners, not competitors.

The lasting effects of the maquiladora manufacturing industry on Mexico’s economy include:

- higher levels of productivity

- employment growth

- new technology transfer and implementation

- creation of a new labor culture

- establishment of new developmental hubs

- among others

Finally, light vehicle production tripled between 1994 and 2016, corresponding to 3.5 million units. Today’s maquiladoras in Mexico produce almost half of the country’s exports.

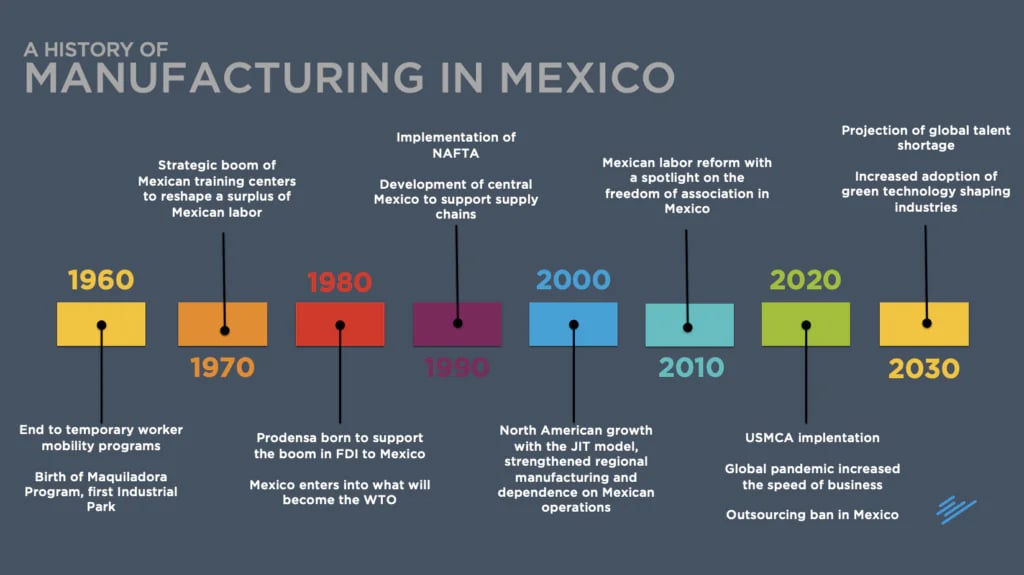

A History of Manufacturing in Mexico

How has Mexico developed to become a key asset in North American manufacturing competitiveness?

The Rise of Maquiladoras in Mexico

The Bracero program refers to agreements between the U.S. and Mexican governments that allowed Mexican workers to fill seasonal jobs on U.S. farms during and after wartimes. As the popularity of the program grew, more and more hopeful Mexicans moved to the U.S.-Mexico border in hopes of being selected. Then industrialization and stagnant wage growth in agriculture caused the dissolution of the program. These abundant border workers prompted the creation of the maquiladora program in 1965. The U.S. investment in assembly factories could provide jobs for ex-Braceros in Mexico.

During the 1970’s, industrial policy diversified its objectives to include export promotion and the strengthening of international competitiveness. The government created the Mexican Institute of Exterior Commerce and lifted some important restrictions on foreign investment and expanded the field of operation of maquiladoras into the country’s interior. In short, policies provided rebates, short-term export credits, and financing.

High population growth through the 1970’s combined with the dissolution of the Bracero Program found Mexico with an abundance of semi-trained labor. A great migration to the cities was occurring. Mexico recognized the need to prepare a technical workforce capable of fulfilling the growing maquiladora industry.

Accompanying an overall growth in the maquiladora industry in Mexico, the focus shifted from purely assembly-related investments to also include more advanced manufacturing processes. During the decade, Mexico shifted its auto industry policy toward export promotion. Vehicle manufacturers responded by opening modern and competitive plants in Mexico.

After an economic stagnation and debt crisis, Mexico takes the first step toward reducing its trade barriers by joining the General Agreement on Tariffs and Trade (GATT). It will later become the World Trade Organization.

Gaining Strength by Forging Partnerships

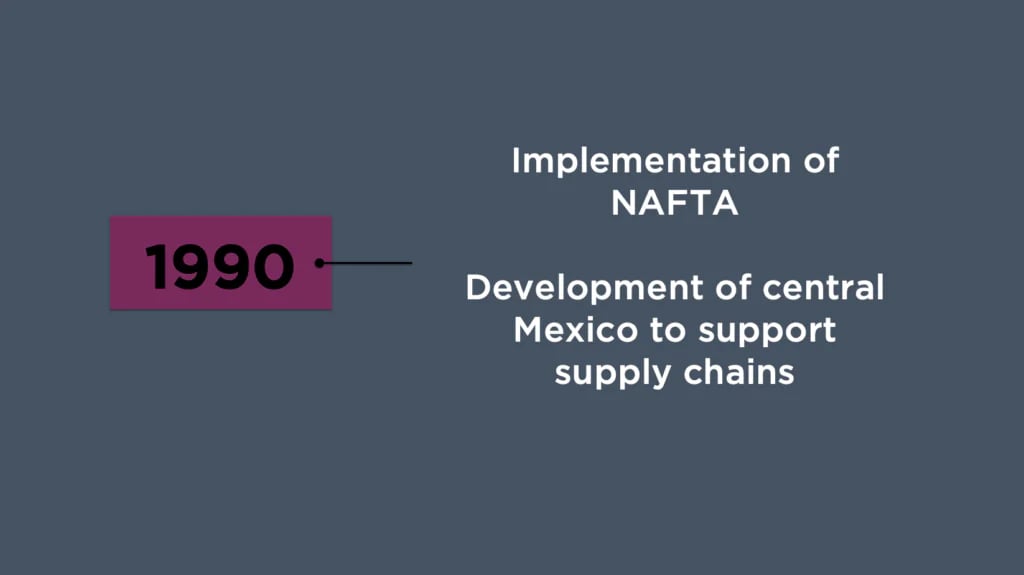

In the early 1990’s, Mexico lowered a number of agricultural trade barriers and in 1994 joined Canada and the United States on implementing the North American Free Trade Agreement (NAFTA). The deal created the second-largest trading bloc and opened the door to expanded diplomatic cooperation between the United States and Mexico. Most economics conclude that the deal boosted overall economic growth, including more than tripling North American trade and helping to transform Mexico’s economy.

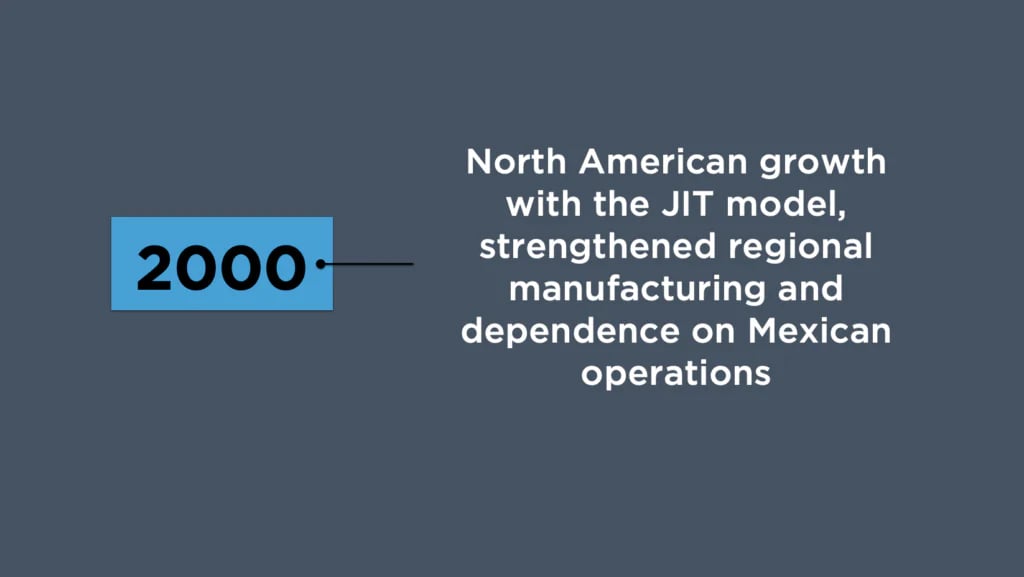

During the 2000’s Mexico underwent an accelerated development, thanks mainly to the confidence of foreign investors and the development of the Just-in-Time model of manufacturing that relied on more agile, local supply chains. Administrations in Mexico and the United States vowed to expand trade relations, immigration reform and economic liberalization.

At the end of the decade, Mexican manufacturing underwent a crisis before rallying again in 2010.

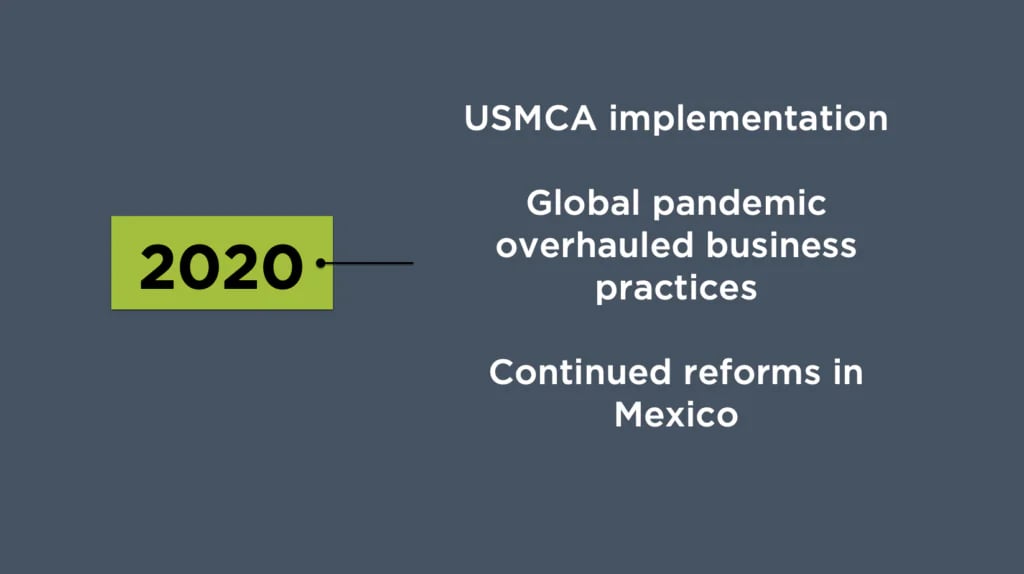

Well into the first decade of 2000, Mexico and US announce initiatives for continued bilateral cooperation under Presidents Obama & Peña Nieto. In 2019, Mexico surpasses Canada and China to become the United States’ top trading partner. Bilateral trade totaled $615 billion. At the same time, Mexico overhauls their Labor System to improve their labor justice system and freedom of association for workers.

The USMCA replaced NAFTA in 2020, outlining changes to regional content for goods manufactured in North America, reforms to dispute resolution mechanisms, and stronger labor protections. The global pandemic brought about a new set of challenges including supply chain agility and nearshoring initiatives to North America. Both Mexico and the United States renewed their infrastructure priorities in part to increase North American manufacturing competitiveness.

Read about what’s at stake in the scheduled USMCA review in 2026.

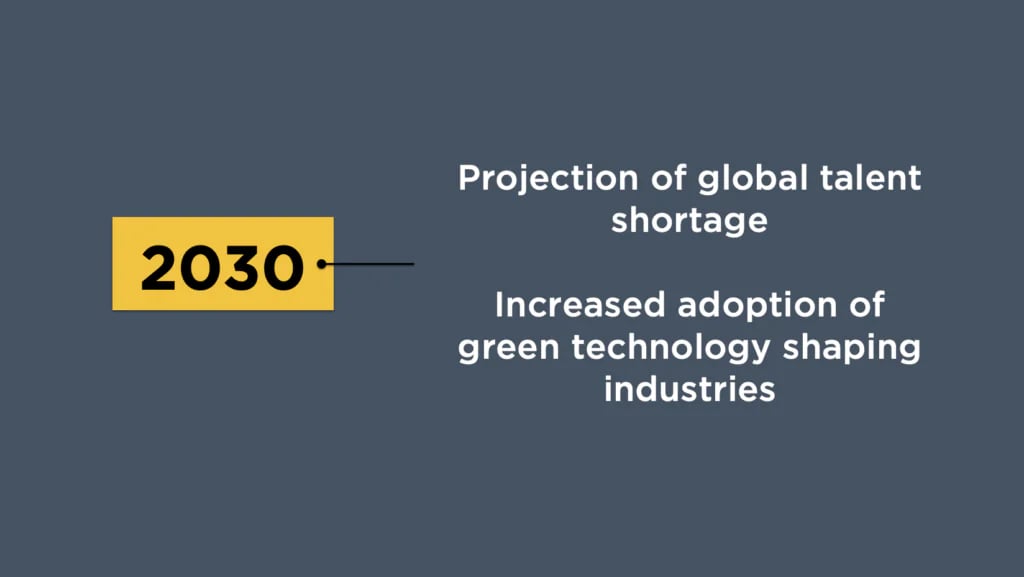

This decade will continue to develop green technologies that further transition industries. Supply chains will evolve, and new players will get quickly folded in. Agility is the name of the game, and consumers rule. Mexico will continue to strengthen its position as key manufacturing parter to the United States, despite sociopolitical challenges that threaten infrastructure and energy-preparedness.

Read about our outlook on the U.S.-Mexico collaboration in 2024.

The Future of Manufacturing in Mexico

Over the next decade, manufacturing as we know it will experience profound changes. The output of the next industrial revolution will depend on how consumerism and workforce demands evolve. The post-pandemic industry is in “design mode”, solving challenges in workforce shortage, supply chain instability, smart factory initiatives, cybersecurity and ESG investment goals.

Mexico’s manufacturing sector is poised for further evolution. The key to capitalizing on its potential as a major manufacturing hub as a future relies on:

- embracing automation as a region

- fostering innovation in the supply chain

- developing a skilled and agile workforce

Mexico will continue to be a strategic alliance for US manufacturing, with complementary capacities and strong intra-regional trade. Nearshoring efforts show no signs of stopping, and trilateral cooperation and diplomacy are the way forward for North America.